Let's be real. Outsourced finance and accounting isn't some corporate buzzword. It’s the single best hack for getting a world-class finance department without mortgaging your office ping-pong table for a six-figure CFO. It’s how smart companies get elite financial strategy and flawless execution, letting you punch way above your weight class.

You didn’t quit your job to become a part-time bookkeeper, but here you are, drowning in invoices, chasing receipts, and praying last quarter’s spreadsheet is more fact than fiction. Sound familiar?

This is the slow-burn panic that sets in when your DIY finance setup finally buckles under its own weight. It's the gut punch you feel when you realize your "back office" is quietly sabotaging your growth.

This isn't about feeling bad; it’s about spotting the red flags before your company catches fire. If these symptoms are hitting a little too close to home, you’re already in trouble:

Look, the homegrown finance function has a painfully short shelf life. What worked for a two-person team in a garage will actively choke the life out of a 20-person company trying to scale.

The real breaking point? It always comes when you're gearing up for a funding round or a big strategic pivot. Suddenly, the "good enough" numbers you've been running on are nowhere near good enough for people with actual money.

Turns out you’re not alone in this mess. The global finance and accounting outsourcing market is exploding for a reason. Projections show it’s on track to hit $81.25 billion by 2030 because more and more founders are finally admitting they can’t—and shouldn’t—do it all themselves.

In the U.S. alone, 37% of businesses are expected to outsource their accounting by 2025, driven by a brutal talent shortage and the need for better tech. Smart companies are seeing cost savings of 20-60%, freeing up precious cash to pour back into what actually matters: growth. You can read the full research on accounting outsourcing trends if you like nerding out on stats.

This isn’t a trend; it's a strategic intervention. It’s about swapping the constant, low-grade anxiety of managing your own books for the clarity that comes from having actual pros in your corner. Think of it as the financial upgrade your balance sheet has been begging for.

So you’re convinced. Doing it all yourself is a one-way ticket to burnout and bad decisions. But "outsourced finance and accounting" gets thrown around so much it’s almost meaningless. It’s not about finding the cheapest bookkeeper on the planet. That’s like saying all cars are the same. A Ferrari and a Ford Escort will both get you to the grocery store, but one is built for performance.

Let's cut the crap. Think of it like hiring a chef. Do you need someone to just chop vegetables (basic bookkeeping), run the entire kitchen (managed accounting), or design the menu and run the whole damn restaurant (full-stack CFO services)? Each solves a totally different problem.

This is your entry-level, "vegetable chopper" option. You're buying a slice of a larger firm's time, and your work gets handled by a pool of people serving a bunch of other clients.

It's a solid way to get annoying, transactional tasks off your plate—think basic bookkeeping, payroll, or accounts payable. The big draw here is the price. You’re not paying for a dedicated person, just the output.

A QuickBooks Virtual Assistant is a perfect example. It's a scalpel for a specific, painful problem, not a full surgical team.

Now we’re talking. This is like hiring a "kitchen manager." It’s a huge step up. With managed services, you hand over an entire function—like your whole accounting process—to a dedicated provider.

They don't just do tasks; they own the outcome. They bring their own battle-tested processes, their own tech stack, and a team that runs your finance function like a machine. You get consistency, clean reporting, and a single point of contact who actually understands your goals.

This is where you stop just offloading work and start gaining real leverage. You’re buying a system, not just a pair of hands.

The provider is on the hook for making sure everything is accurate, on time, and efficient. This is the sweet spot for growing businesses that need professional-grade finance without the agony of building a department from scratch. It’s about a predictable, high-quality result, every single month.

This is the full "executive chef" experience. Here, you’re not just outsourcing a function; you’re building a remote extension of your own company. You get a hand-picked finance team that works only for you. They learn your culture, your inside jokes, and your strategic goals.

This model gives you the control of an in-house team with the cost-efficiency and talent access of outsourcing. Your "team" could be a bookkeeper, a controller, and a fractional CFO, all working in lockstep and plugged directly into your daily operations.

This is where the nearshore vs. offshore debate gets real. Time zones and cultural alignment are everything here. The differences between nearshore and offshore teams (https://lathire.com/offshore-vs-nearshore/) aren't just details; they fundamentally change how your dedicated team integrates with your core business. Choose wisely.

Everyone loves to talk about the cost savings of outsourced finance and accounting. It’s the headline on every provider’s website, usually next to a stock photo of someone laughing alone with a spreadsheet. But focusing only on saving a few bucks is like buying a race car for its cup holders. You’re missing the whole point.

The real game-changer is turning your finance function from a fixed, soul-crushing cost center into a variable, performance-driven asset. Let’s get into the nitty-gritty numbers, because that’s where the story gets interesting.

That junior accountant you’re thinking of hiring for $60k a year? That’s not a $60k expense. Not even close. That’s just the tip of the iceberg, my friend, and what’s below the surface will sink your company.

Let's talk about the fully-loaded cost of an employee. This is the real number, the one that includes all the "little things" that bleed you dry.

Suddenly, that $60k hire is actually an $85,000 hole in your budget. And for that price, you get one person with one skill set who will make mistakes, take vacations, and eventually leave—forcing you to start this whole miserable cycle all over again.

The biggest hidden cost? Your time. Every hour you spend managing payroll or fixing a bookkeeping error is an hour you didn't spend on product, sales, or strategy. That opportunity cost will kill you faster than anything else.

Now, let's look at the alternative. Take that same $60k budget—not the loaded $85k, just the base salary—and point it at a specialized outsourced finance and accounting team. What does that buy you?

Instead of one junior person, you get a whole team: a bookkeeper for the trenches, a controller for month-end close, and a fractional CFO for high-level strategy. They bring their own software, their own proven systems, and a depth of experience your single hire couldn't dream of.

Here’s a quick, no-fluff comparison of where the money really goes:

| Cost Component | In-House Accountant (Annual) | Outsourced Team (Annual) |

|---|---|---|

| Base Salary | $60,000 | N/A (Included in Service Fee) |

| Benefits & Payroll Taxes | ~$18,000 | $0 |

| Recruiting & Training | ~$5,000 | $0 |

| Software Licenses | ~$1,500 | $0 (Provider's Stack) |

| Office Overhead | ~$4,000 | $0 |

| Mistakes & Downtime | Variable (but never zero) | Minimized by Expert Team |

| Total Estimated Cost | ~$88,500+ | ~$50,000 – $70,000 |

The numbers don't lie. But the real ROI isn't just the cash you save. It’s the efficiency and strategic firepower you gain, which can easily deliver a 3x return on your investment.

To see how remote talent crushes overhead, our guide on the cost-effectiveness of hiring remote talent from LatAm has all the juicy details.

Outsourcing isn't about spending less. It’s about spending smarter. It’s about turning a sunk cost into a strategic weapon.

Choosing a partner for your outsourced finance and accounting feels like navigating a minefield in the dark. One wrong step and you’re locked into a year-long contract with a team that thinks “startup speed” means sending reports two days late instead of three. It’s a painfully common story.

This is your survival guide. We’re going beyond the glossy sales decks. This is the painfully honest checklist you need to find a true partner, not just a glorified data-entry clerk.

Any firm can promise you the moon. They all have slick websites and case studies featuring companies you’ve never heard of. Your job is to poke holes in their story until you find the truth.

First, their tech stack. Don't let them get away with "we use the latest cloud-based tools." Which ones? Do they have expertise in the platforms you already use? A huge red flag is a firm that forces you to migrate your entire financial life to their obscure, preferred software.

Next, hit them on security. Hard. This isn't a "nice to have," it's a dealbreaker.

A pro firm won’t just tolerate these questions—they’ll welcome them. Their whole business rests on trust. If they get defensive, you have your answer.

Let’s settle this once and for all. This isn't just about cost. Choosing between a team in Latin America (nearshore) and one in Asia (offshore) has massive implications for how you'll actually work together. I've tried both. The difference is night and day.

Offshore wins on sticker price, but you pay for it in a thousand other ways. A 12-hour time difference means your “quick question” at 2 PM gets answered while you’re asleep. Those delays create a friction that slowly grinds everything to a halt.

Nearshore, on the other hand, operates in your time zone. This isn't a small perk; it’s a game-changer. Your outsourced team feels like an extension of your staff because you can jump on a call and solve a problem in five minutes. The cultural alignment is stronger, too, cutting down on the misunderstandings that plague offshore relationships.

This isn’t a hunch. The market is voting with its wallet. With 51% of finance managers struggling to hire, nearshoring to Latin America is booming, with a projected 17% demand surge through 2026. Smart CFOs are realizing that time-zone alignment is worth more than the lowest possible hourly rate.

The final test is the most important: do they think like a partner or a vendor? A vendor just executes tasks. A partner challenges your assumptions and actively looks for ways to make your business better.

During the sales process, do they ask smart questions about your business model and growth plans? Or are they just trying to shove you into a pre-packaged plan? When you're ready to find a provider, it's critical to understand the key factors to consider when selecting an outsourcing partner.

You need a team that gets companies at your exact stage. A firm that serves Fortune 500s won't understand the beautiful chaos of a seed-stage startup. Ask for references from companies that look like yours. And actually call them.

Finding the right team is everything. If you want to skip some of the guesswork, exploring established business process outsourcing providers can give you a curated list of teams that have already been put through the wringer. It's a big decision, but getting it right is one of the best you'll ever make.

So you did it. You vetted the vendors, dodged the salespeople, and signed the contract. The hard part is over, right?

Wrong. A botched onboarding can poison a perfectly good partnership, leaving you with months of frustration and that sinking feeling you’ve made a terrible mistake.

I’ve seen it happen. The first 90 days are where the relationship is either forged in fire or crumbles into a pile of passive-aggressive emails. This isn’t about handing over your logins and hoping for the best. It’s about building a system.

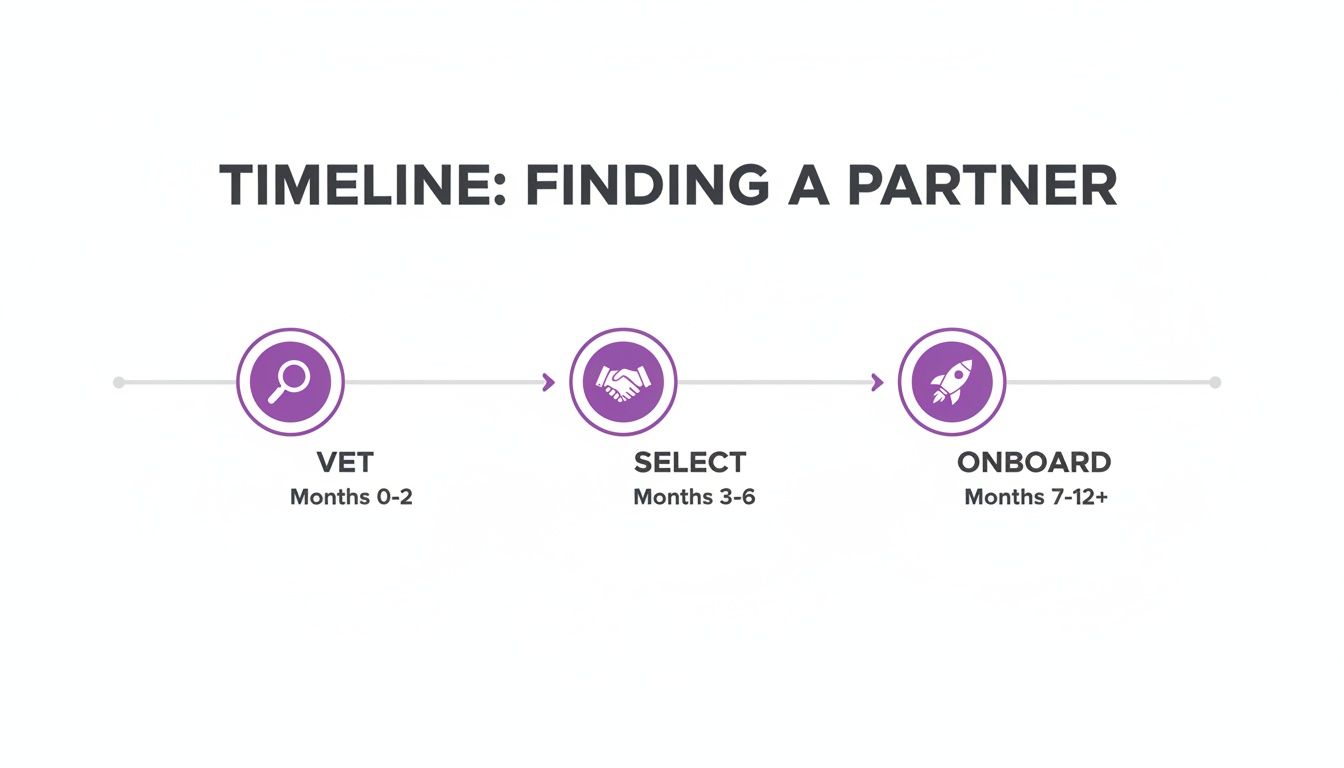

This timeline shows the bigger picture, from search to success.

As you can see, onboarding isn't a switch you flip. It’s a dedicated phase that sets the foundation for years of success.

The first 30 days are all about knowledge transfer. You’re giving your new partner a guided tour of your company’s financial brain—including the ugly spreadsheet you’re embarrassed to show anyone.

Front-load the effort here so you can be hands-off later.

Okay, the training wheels come off. The new team takes the lead. Scary, I know, but necessary. Your job shifts from "doing" to "reviewing." You’re stress-testing the system you just built.

By now, this should feel less like a project and more like business as usual. The focus shifts to refinement and holding the team accountable. This is where you start to see the real ROI.

If you get to the end of 90 days and you're still chasing your provider for basic reports, something is fundamentally broken. This period is the ultimate proof of concept.

It’s time to move beyond basics and get the strategic insights you paid for.

Alright, let's get into it. You’ve seen the pitch, but that healthy founder skepticism is kicking in. Good. Making a smart call on your outsourced finance and accounting partner means asking the tough questions.

I’ve been there, and I’ve asked all of these myself. Here are the straight, no-bull answers.

Nope. It’s the other way around. Startups get the biggest bang for their buck. Massive corporations can afford to build huge, bloated finance departments. You can't.

Outsourcing is the great equalizer. It gives you instant access to enterprise-level expertise—like a fractional CFO who can build a model that investors won't laugh at—without the six-figure price tag. It lets you sink your cash into product and growth, not your back office. It's about getting the right expertise at the right time, whether you have 10 employees or 100.

This is non-negotiable, and any partner worth their salt will have a far better security setup than you could ever build. Let's be blunt: your financial data is probably safer with a specialized third party than it is sitting on your marketing manager’s laptop.

Why? Because their entire business is on the line.

When vetting a firm, go for the jugular.

A professional firm is built to mitigate security risks far more effectively than a typical startup ever could.

The irony is that the biggest security holes usually come from inside your own company. A specialized outsourced firm is built from the ground up to prevent that.

This trips up so many founders. Confusing the two is like confusing a reporter with a strategist. One gathers facts, the other tells you what to do with them.

Bookkeeping is recording the past. A bookkeeper's job is to meticulously log every single transaction. It’s the foundational grunt work.

Accounting is interpreting the past to shape the future. An accountant takes that clean data and turns it into business intelligence. They prepare financial statements, manage tax compliance, and deliver the insights you need to make smart decisions.

A great outsourced partner does both, and then adds that strategic CFO layer on top. Don’t hire a bookkeeper when what you really need is an accountant—or better yet, a full-stack finance team.

This is the number one fear, and it comes from a good place. You built this company from nothing; handing over the financial reins feels terrifying.

But here’s the truth: good outsourcing gives you more control, not less.

You aren't handing over the keys and walking away. You're upgrading your dashboard from a messy spreadsheet to a high-definition control panel. Instead of drowning in transactions, you get clear, accurate, timely reports.

Your role evolves from task manager to strategist. You’re no longer the one chasing invoices or fixing miscategorized expenses. You’re the one making critical decisions based on reliable data. A strong partner creates so much transparency that you end up with more financial visibility, not less.