Let's be real. Nobody starts a business dreaming of calculating withholdings, filing payroll taxes, or deciphering state-by-state compliance laws. You wanted to build something great, not become an amateur accountant. I’ve been there, wasting entire Tuesdays on payroll runs that should have taken minutes, convinced I was 'saving money' by doing it myself. Spoiler alert: I wasn't.

The real cost isn't a software subscription; it's your time, your sanity, and the risk of one tiny mistake that brings the IRS knocking. After trying to DIY it with duct-taped solutions and nearly mortgaging the office ping-pong table to hire a full-time finance person, I finally embraced the obvious. Finding one of the best outsourcing payroll companies isn't an expense; it's one of the highest-leverage decisions a founder can make. It frees you up to focus on growth, not administrative drudgery.

But which one? The market is a sea of generic promises and confusing pricing tiers. That's why we did the dirty work. We’ve used them, critiqued them, and are here to give you the straight-up, no-fluff breakdown of who's actually worth your money.

This guide is a comprehensive showdown of the top platforms, from global hiring specialists like LatHire to HR powerhouses like ADP and Rippling. We'll dive into their core features, who they're really for, and what the pricing song-and-dance is all about. For each provider, you'll find direct links and screenshots to help you visualize how they work, so you can stop wrestling with spreadsheets and start scaling your business.

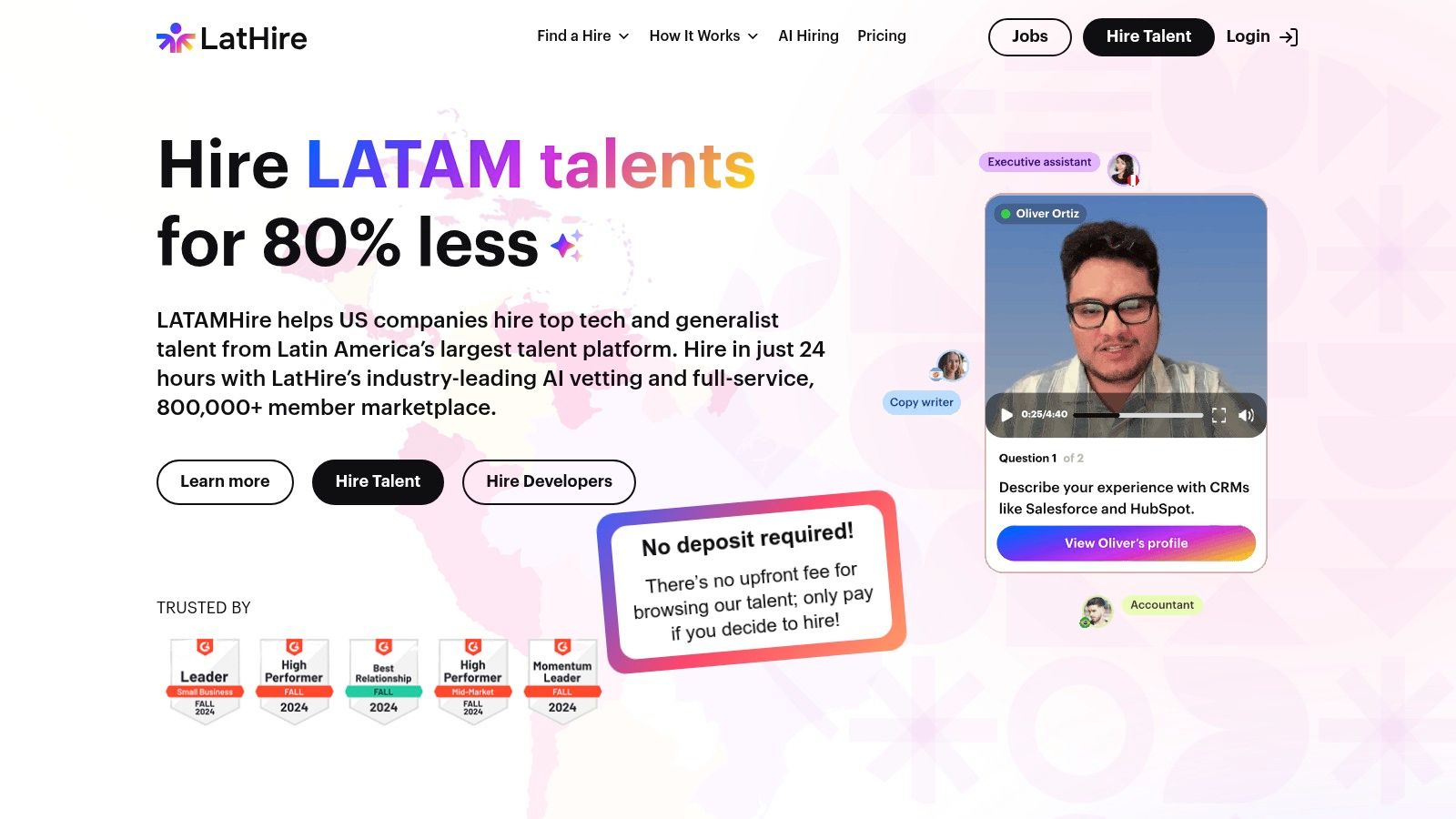

LatHire isn't just another name in the crowded space of outsourcing payroll companies; it’s a strategic weapon for scaling your business. Think of it as your all-in-one command center for hiring elite talent from Latin America while completely sidestepping the logistical nightmare of international payroll, HR, and compliance. It’s built for founders who'd rather focus on building products than figuring out cross-border tax law.

Let’s be honest, the moment you decide to hire internationally, you’re usually faced with two terrible options. You can drown in paperwork trying to manage it all yourself, or you can hire one service for talent sourcing, another for payroll, and a third for legal compliance. It’s a mess. LatHire’s genius is consolidating all of this into a single, elegant platform. It’s less of a service and more of an extension of your own team. Toot, toot!

What truly sets LatHire apart is its integrated approach. While many platforms can find you a candidate or process a payment, LatHire handles the entire employee lifecycle. From sourcing and AI-powered vetting to onboarding, payroll, benefits, and ongoing legal compliance, it's an end-to-end solution. This is a massive advantage for any company that lacks a dedicated international HR department. In other words, most of us.

The platform's proprietary AI doesn’t just match keywords on a resume. It runs deep skills evaluations and combines them with human-led background checks to ensure you’re only meeting the top 3% of talent. This means you skip the part where you spend weeks interviewing candidates who look great on paper but can't actually code their way out of a paper bag.

Imagine you need three senior DevOps engineers and two UX designers, like, yesterday. Instead of posting on a dozen job boards and hoping for the best, you upload your job descriptions to LatHire. Within a day, you get a shortlist of pre-vetted candidates who have already passed technical assessments.

Once you make your hires, LatHire handles everything else. It sets up compliant employment contracts, manages their monthly payroll in their local currency, and ensures all tax obligations are met. You get one simple invoice. They get a seamless, professional employment experience. This is how you scale a team without scaling your administrative burden.

Pros & Cons

| Pros | Cons |

|---|---|

| Vast, Vetted Talent Pool: Access to 800,000+ top-tier professionals across LATAM. | Niche Role Costs: Highly specialized tech roles might come at a higher price point compared to generalist positions. |

| All-in-One Platform: Combines recruitment, payroll, HR, and compliance into a single service. No more duct tape. | Onboarding Curve: Businesses new to international hiring may need a short period to familiarize themselves with the platform. |

| Significant Cost & Time Savings: Reduces hiring costs by up to 80% and time-to-hire by over 80%. | |

| Time-Zone Aligned: All talent works in US and Canadian time zones for smooth collaboration. | |

| No Hidden Fees: Payroll and HR management are included in the service cost. |

Bottom line: LatHire is a powerful choice for any company looking to tap into global talent without the operational headaches. It excels at being a comprehensive partner, making it a standout among outsourcing payroll companies.

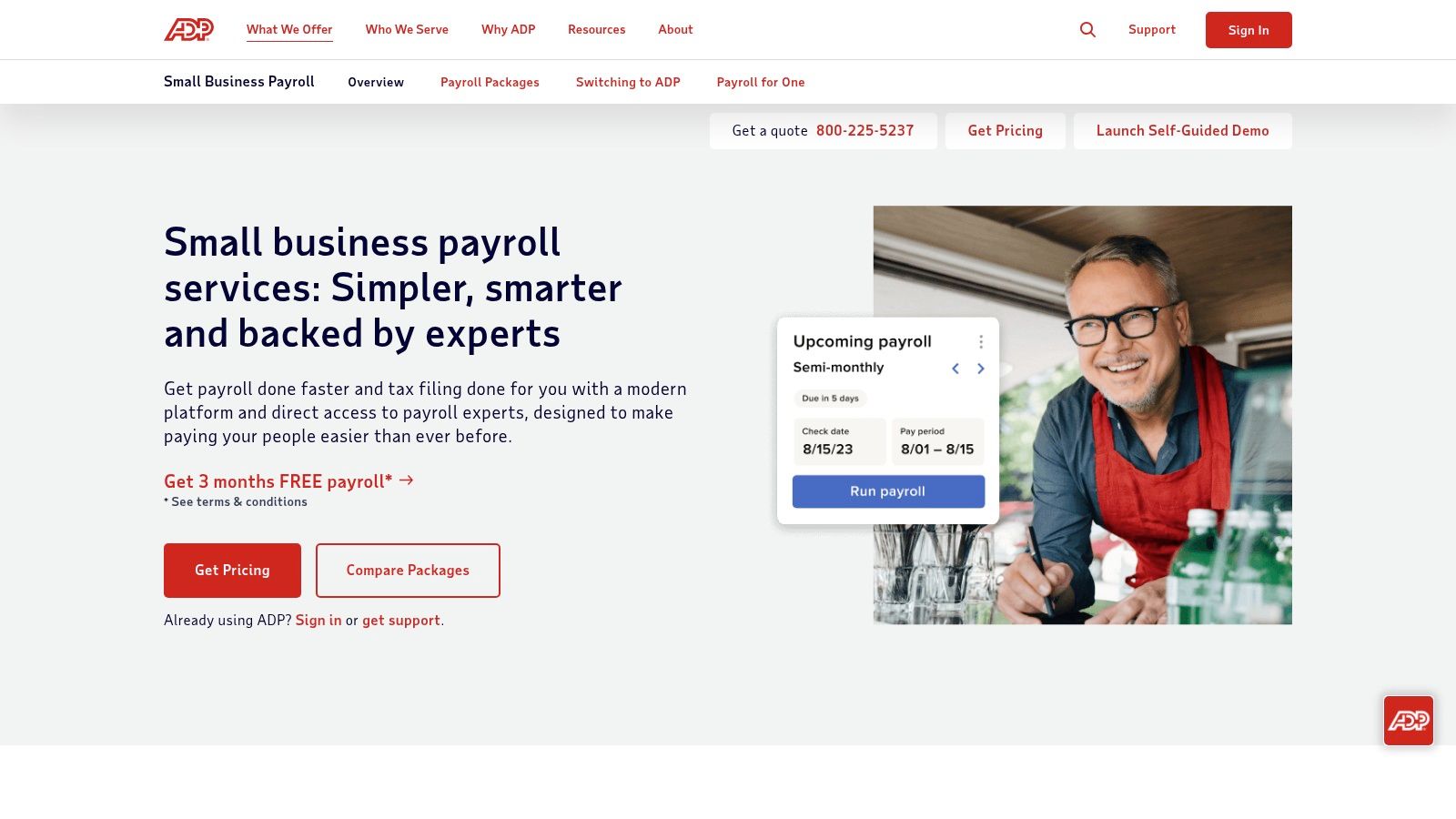

If you've been in business for more than five minutes, you've heard of ADP. They are the behemoth of the payroll world, the seasoned veteran that has seen it all. But don't mistake their long history for being outdated. ADP offers a fascinating dual approach: a choice between their managed payroll software (RUN) and a full-blown Professional Employer Organization (PEO) service (TotalSource).

This flexibility is ADP's killer feature. You can start with RUN, a powerful DIY-plus-support tool, and then graduate to TotalSource when you're ready to hand over the keys to your entire HR function. It’s a scalable path that grows with you, which is a massive advantage over platforms that force you into a one-size-fits-all box.

So, what's the real difference? Think of it this way:

Here's the catch: ADP doesn't do transparent, on-the-box pricing. You have to get a custom quote, which can feel a bit like buying a used car. The price for both RUN and TotalSource depends on your employee count, services needed, and location. While this means you get a tailored package, it also means you can't just sign up online in ten minutes. Prepare for a sales call.

Founder’s Tip: When getting your quote, be crystal clear about which add-ons you actually need. The ADP Marketplace is vast, and it’s easy to get upsold on features you might not use for another year. Start lean.

Pros & Cons

| Pros | Cons |

|---|---|

| Scalable Path: Grow from managed payroll (RUN) to a full PEO (TotalSource) within one ecosystem. | Opaque Pricing: You must contact sales for a custom quote, which complicates quick comparisons. |

| Compliance Powerhouse: Unmatched expertise in tax and labor law, reducing your compliance risk. | Potential Complexity: The sheer number of features can be overwhelming for very small or simple businesses. |

| Massive Integration Marketplace: Connects with virtually any software you're already using. | Sales-Driven Process: Getting started requires navigating a sales process rather than a simple self-signup. |

| Brand Recognition & Reliability: A long-standing, trusted name in the industry. |

ADP's place on this list is earned through its sheer scope and scalability. It’s a rock-solid choice for businesses that value compliance and want a partner that can handle their needs from startup to enterprise without forcing them to switch platforms.

If ADP is the payroll behemoth, Paychex is its equally powerful, yet slightly more flexible, cousin. They are another household name, but where they really shine is in tailoring solutions for small to medium-sized businesses. Paychex gets that a 10-person agency doesn't need the same HR firepower as a 200-person factory, and their service model is built around that.

The core appeal is its tiered, bundled approach. You pick a plan that feels right-sized for your current needs without paying for a mountain of enterprise features you'll never touch. This makes them a go-to for businesses that want a full-service partner and dedicated support but aren't quite ready for the all-in commitment of a PEO.

Paychex breaks down its offerings into distinct packages, which helps clarify what you're actually buying.

Just like ADP, Paychex keeps its pricing under wraps. You won't find a pricing grid on their site; instead, you have to contact their sales team for a custom quote. Again, be prepared to discuss your employee count, pay frequency, and what level of HR support you need.

Founder’s Tip: Your dedicated payroll specialist is your biggest asset with Paychex. During the sales call, ask specifically about their support model. Confirm that you will be assigned a specific person, as this is a key differentiator from purely software-based solutions.

Pros & Cons

| Pros | Cons |

|---|---|

| Dedicated Specialist: Higher-tier plans offer a named contact for your payroll needs—a huge plus. | Opaque Pricing: Custom quotes are mandatory, making it difficult to do a quick price comparison. |

| Scalable Bundles: Clear service tiers make it easy to choose a package that fits your company size. | Upselling to Higher Tiers: Core HR features like employee handbooks are locked behind more expensive plans. |

| Full-Service Tax Compliance: They handle all federal, state, and local tax filings. | Interface Can Feel Dated: While functional, the UI isn't as modern or slick as some newer competitors. |

| Industry Veteran: Over 50 years of experience means deep expertise in payroll and compliance. |

Paychex is the ideal choice for business owners who value a human touch. If the thought of navigating payroll tax law alone gives you a headache and you want an expert you can call directly, Paychex offers a proven path to peace of mind.

If the traditional payroll world is a stuffy corporate boardroom, Gusto is the trendy startup office with a kombucha tap. It’s designed from the ground up for modern small businesses that don’t just want payroll; they want an all-in-one people platform that’s genuinely delightful to use. Gusto has carved out a massive following by making complex HR tasks feel simple, intuitive, and almost… fun.

The secret sauce is its unified approach. Instead of bolting on HR features as an afterthought, Gusto bakes everything from employee onboarding and benefits to time tracking directly into its core payroll service. For a founder wearing a dozen hats, this integration is a lifesaver. It’s one login, one system, and one source of truth for all things employee-related.

Gusto's model is about selecting a tiered plan that fits your HR maturity.

Here’s where Gusto really flips the script on the old guard: transparent pricing. You can go to their website right now and see exactly what you’ll pay. No sales calls, no custom quotes, no mystery fees. This alone is a huge win for busy founders.

This upfront approach removes a major friction point. You can evaluate, buy, and set up the platform entirely on your own schedule. While they have seen some price increases recently, the transparency remains a key differentiator.

Founder’s Tip: Start with the Simple or Plus plan. Gusto makes it incredibly easy to upgrade when you actually need more advanced features. Don’t pay for the premium tools until the need becomes a real pain point.

Pros & Cons

| Pros | Cons |

|---|---|

| Upfront, Transparent Pricing: No need for a sales call; you can see costs and sign up online in minutes. | Gets Pricey at Scale: The per-employee cost can become less competitive for larger teams compared to enterprise solutions. |

| Beautifully Integrated UI: The user experience for both admins and employees is clean, modern, and easy. | Limited HR Depth: While great for basics, it lacks the deep compliance and risk management of a full PEO. |

| Excellent for Small Businesses: Perfectly tailored for startups and SMBs that need payroll plus foundational HR. | Core Features in Higher Tiers: Key tools like multi-state payroll are locked behind more expensive plans. |

| Strong Employee Self-Service: Empowers employees to manage their own info, reducing your admin work. |

Gusto is the go-to choice for tech-savvy small businesses that prioritize user experience and transparency. It’s one of the best outsourcing payroll companies if you want a partner that feels less like a corporate vendor and more like an extension of your own friendly, modern team.

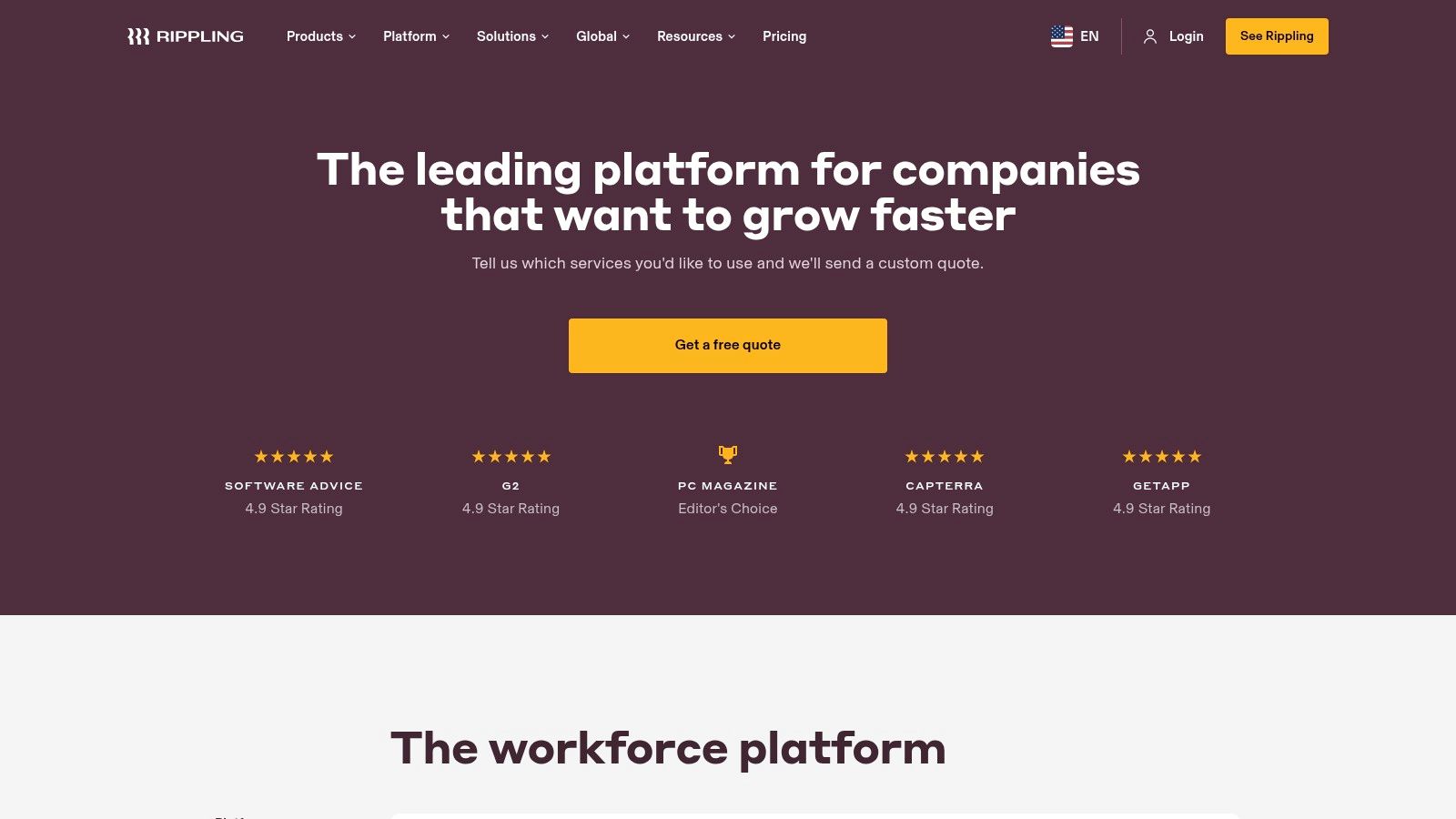

If traditional payroll software is a Swiss Army knife, Rippling is the entire workshop. It's built on a fundamentally different idea: What if payroll was the central hub for your entire employee operation, from IT and HR to finance? Rippling's "employee cloud" concept is a game-changer for tech-forward companies tired of duct-taping five different systems together.

This platform isn't just one of the best outsourcing payroll companies; it's an operating system for your business. When you hire someone, Rippling doesn't just add them to payroll. It can automatically order their laptop, grant them access to Slack, and enroll them in benefits. When they leave, it reverses the entire process with a single click. This deep integration is Rippling's superpower.

Rippling's magic lies in its modularity. You build the exact system you need, bolting on HR, IT, and finance tools as required.

Like many enterprise-grade platforms, Rippling keeps its pricing behind a "request a demo" wall. The cost is modular, starting at $8 per user per month, but your final quote will depend entirely on which modules you activate. This ensures you only pay for what you use, but it means you can't just see a price tag and sign up.

Founder’s Tip: Map out your entire employee process before your demo call. Know exactly which systems you want to consolidate (payroll, benefits, app provisioning) to get an accurate quote. It's easy to get excited and add every module, so start with your biggest pain points first.

Pros & Cons

| Pros | Cons |

|---|---|

| All-in-One Platform: Drastically reduces tool sprawl by combining payroll, HR, and IT. | Custom Pricing: No transparent pricing makes it hard to budget without a sales call. |

| Powerful Automation: Saves countless hours by automating cross-departmental workflows. | Potential Overkill: The vast configurability might be too complex for very small teams with simple needs. |

| Excellent for Global Teams: Seamlessly manages both US and international payroll in one place. | |

| Strong Market Reputation: Highly rated by users on platforms like G2 for its power. |

Rippling earns its spot by reimagining what a payroll platform can be. It's the ideal choice for modern, tech-savvy companies that see payroll not as an isolated task, but as the engine for their entire people operations. By choosing an innovative partner like a payroll outsourcing agency, you can streamline your processes even further.

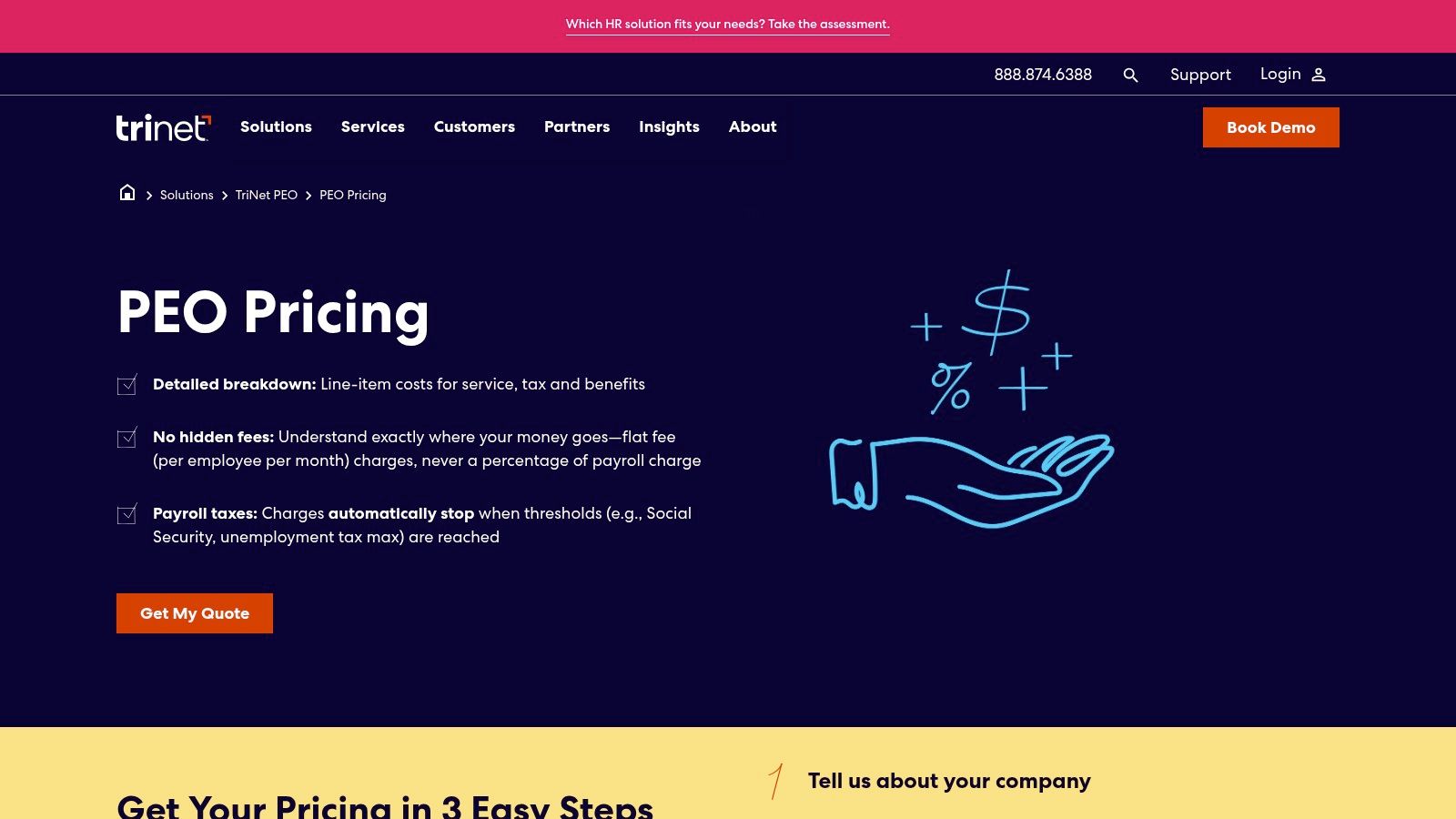

TriNet is the expert you call when you're ready to stop playing HR manager and get back to actually running your company. They are a pure-play Professional Employer Organization (PEO) at their core, operating on a co-employment model. This isn't just about outsourcing payroll; it's about handing over the entire HR, benefits, and compliance apparatus to a team of specialists.

What makes TriNet stand out is its industry-specific focus. They don't just offer generic HR support; they provide dedicated teams with expertise in tech, life sciences, financial services, and more. This means you get compliance advice and benefits packages tailored to the unique challenges of your industry—a huge leg up when competing for top talent.

TriNet understands that not everyone is ready to jump into a co-employment relationship. That's why they offer two distinct paths:

When considering options like TriNet, it's worth exploring their capabilities for managing global talent and understanding the effective methods for paying international contractors. While PEOs are often U.S.-focused, the principles of expert-led compliance and administration apply globally.

TriNet is more transparent about its model than many competitors, even if you still need a custom quote. They typically use a per-employee-per-month (PEPM) fee structure. The final cost will depend on your employee count, industry, location, and benefits package. The process starts with a consultation to tailor a package to your exact needs.

Founder’s Tip: During your consultation, lean into their industry expertise. Ask specific questions about compliance challenges in your sector. Their answers will quickly reveal the depth of their value proposition compared to a more generic service.

Pros & Cons

| Pros | Cons |

|---|---|

| Deep Industry-Specific Expertise: Tailored HR and compliance support for sectors like tech. | Custom-Quoted Pricing: While the model is clear (PEPM), final costs require a sales consultation. |

| Full HR Offloading: The PEO model truly lets you set-and-forget HR administration. | Co-Employment Model: This structure can limit your direct control over certain HR functions. |

| ESAC-Accredited PEO: Provides a financial safety net and assurance of compliance. | Primarily U.S.-Focused: Less ideal for companies with a heavy international employee presence. |

| Flexible Options (PEO vs. HR Plus): A path for companies not ready for full co-employment. |

TriNet is a premier choice for established businesses that recognize HR is not their core competency. If you value industry-specific compliance and want access to enterprise-level benefits, TriNet is one of the best outsourcing payroll companies to have on your shortlist.

Alright, this one's a bit different. Think of G2 not as a payroll provider, but as your secret weapon for choosing one. It’s the ultimate B2B software marketplace, the Yelp for business tools, and an essential first stop before you commit to anyone else on this list. Instead of selling you payroll, G2 aggregates verified user reviews and feature comparisons for dozens of outsourcing payroll companies.

This isn't just about reading a few curated testimonials. G2 provides a transparent, unfiltered look into what it's actually like to use these platforms day-to-day. It’s your defense against slick sales pitches and a way to hear directly from founders and HR managers who've already walked the path you're on.

G2 is more than just a list of reviews; it's a powerful research tool. Here’s how to use it right:

Accessing G2 is completely free. You don't need to sign up or provide any payment info to browse, read, and compare. The platform makes its money from vendors who pay for premium profiles. This means you can conduct your research without any obligation. When you're ready, G2 provides direct links to vendor websites to request a demo or get a quote.

Founder’s Tip: Pay close attention to the "What do you dislike?" section of the reviews. This is where users voice frustrations about hidden fees, difficult implementation, or poor customer support—the exact red flags you want to know about before you sign a contract.

Pros & Cons

| Pros | Cons |

|---|---|

| Unbiased, Verified Reviews: Get real-world insights from actual users, not just marketing copy. | Incomplete Pricing Data: User-reported pricing can be outdated or absent, requiring direct vendor contact. |

| Powerful Side-by-Side Comparisons: Easily evaluate features and ratings across multiple providers. | Popularity Bias: Larger providers often dominate the rankings due to a higher volume of reviews. |

| Free and Accessible: No cost or commitment required to conduct thorough market research. | Review Overload: The sheer volume of information can be overwhelming if you don't use the filters. |

| Comprehensive Vendor Directory: Discover new and niche outsourcing payroll companies you might have missed. |

G2 earns its spot because it empowers you to make a smarter decision. It's an indispensable resource for cutting through the marketing noise and finding the payroll outsourcing company that truly fits your business, backed by the experience of thousands of your peers.

| Item | Implementation Complexity | Resource Requirements | Expected Outcomes | Ideal Use Cases | Key Advantages |

|---|---|---|---|---|---|

| LatHire | Moderate; includes onboarding for international hiring | Requires managing remote hiring and compliance | Access to top 3% Latin American talent, faster hires, cost savings | US/Canadian companies seeking vetted Latin American remote talent | Large vetted talent pool, AI + human validation, full HR & payroll support |

| ADP (RUN, TotalSource PEO) | Moderate to high; depends on chosen service tier | Payroll and HR outsourcing resources needed | Scalable payroll and compliance solutions | Businesses needing payroll with optional PEO HR outsourcing | Flexible payroll or PEO options, strong compliance, many integrations |

| Paychex | Moderate; bundle-dependent | Payroll specialist involvement | Customizable payroll with tax compliance | Companies needing tailored payroll and HR support | Flexible bundles, strong US presence, dedicated payroll specialists |

| Gusto | Low; mostly online setup | Minimal internal resources | Simplified payroll with basic HR tools | Small to growing businesses needing easy payroll & HR | Transparent pricing, easy activation, integrated HR/payroll |

| Rippling | High; modular and configurable | Cross-functional resource alignment | Integrated payroll, HR, IT automation across regions | Distributed teams requiring all-in-one automation platform | Global payroll support, strong automation, modular platform |

| TriNet (PEO and HR outsourced) | Moderate to high; PEO onboarding involved | Outsourced HR/payroll management | Full offload of payroll & HR, compliance assurance | Businesses wanting full HR/payroll outsourcing | Certified PEO, transparent pricing, industry-specific HR expertise |

| G2 — Payroll Category Marketplace | Very low; online comparison tool | No internal resources required | Informed vendor selection with user reviews | Companies researching payroll vendors | Free comparison, verified reviews, pricing insights |

Alright, we’ve laid it all out. We’ve torn down the marketing fluff, kicked the tires on the features, and navigated the pricing jungles of the top outsourcing payroll companies. You’ve seen the legacy giants like ADP and Paychex, the slick modern platforms like Gusto and Rippling, and the all-in PEOs like TriNet. So, what's the final verdict?

The honest answer? The "best" choice is a myth. The right choice is the one that fits the unique, messy, ambitious reality of your business.

This is the fundamental question. Your answer points you directly to the right category of solution.

If you’re solving an admin problem: Your biggest headaches are tax forms, direct deposits, and compliance paperwork. You just want payroll to run smoothly and disappear.

If you’re solving a growth problem: Your core challenge isn't just processing payments; it’s finding, hiring, and retaining the talent you need to scale. Payroll is just the final, necessary step. This is where the calculus changes dramatically.

Let’s be brutally honest. The cost of your payroll software is a rounding error compared to the cost of talent. Shaving a few dollars off a subscription means nothing if you can’t hire the engineers you need to build your product.

This is where a solution like LatHire fundamentally shifts the conversation. It's not just another tool in the long list of outsourcing payroll companies. It reframes the entire process. Instead of asking, "How do I pay my team?" it helps you answer, "How do I build a world-class, cost-effective team, and then handle the payroll and compliance seamlessly?"

The smartest move isn't just optimizing an administrative task. It's optimizing your entire workforce strategy.

Think about it. The traditional path involves finding a recruiter, then a lawyer for contracts, then an EOR for compliance, and finally a payroll provider. It’s a disjointed, expensive, and slow process. A platform that bundles talent acquisition with payroll and compliance isn't just convenient; it's a strategic advantage. You’re not just outsourcing payroll; you’re outsourcing the entire operational headache of global hiring.

So, as you make your decision, my final piece of advice is this: stop shopping for a payroll tool. Start looking for a growth partner. The best outsourcing payroll companies don’t just send money; they remove the friction that stands between you and building the team that will make your vision a reality. Now, go build it.