Paying international contractors should be simple. You agree on a rate, they do the work, you send the money. Easy, right?

Wrong. If you've actually tried it, you know the reality is a tangled mess of contracts, tax forms, and payment methods that seem designed by someone who hates startups. You have to get worker classification right, navigate currency conversions that bleed you dry, and pick a payment system—from old-school bank transfers to shiny new platforms—that doesn't make your best talent want to ghost you.

You finally found her. The perfect backend developer in Brazil. Or maybe it was a brilliant UI designer from Poland. You celebrate, pop the champagne, and feel like a global hiring genius.

Then comes Monday. And with it, the soul-crushing reality of actually getting them paid.

This isn’t like Venmo-ing a friend for pizza. You’re about to step into a maze of currency conversion fees, surprise bank charges, and enough international paperwork to wallpaper your office. I’ve been there, sending those awkward “Did my wire transfer… arrive?” emails and watching payments disappear into the SWIFT network void for days. It sucks.

Let's be blunt: a sloppy payment process is more than just an administrative headache. It actively hurts your business. When you fumble payments, you’re not just an inconvenience; you’re a risk. Top-tier global talent has options, and they won’t stick around for a client who makes payday feel like a game of roulette.

This problem is only getting bigger. The global contractor payments market was valued at $12.8 billion in 2024 and is on a rocket ship to $34.6 billion by 2033. That means more companies are fighting for the same talent. Your payment process is now a competitive advantage, or a liability. There’s no in-between.

The fastest way to lose a great international contractor isn't by paying them too little. It's by making it a nightmare for them to get the money they've already earned. Consistency and reliability beat a few extra dollars every single time.

Beyond the financial friction, a poorly managed system creates real operational dangers. For a deeper look into the potential pitfalls of managing a global team, this guide to human capital risks is a must-read. Every single payment is a touchpoint that reinforces your company’s professionalism—or lack thereof.

Here's what’s really at stake:

This guide is the tough-love chat you need before wiring money into the unknown. Think of me as the seasoned founder who has made all the mistakes so you don’t have to. We’ll break down exactly how to pay international contractors without mortgaging your office ping-pong table.

Let’s get one thing straight right out of the gate. This is the single most expensive, soul-crushing mistake you can make when hiring abroad. It’s not about the invoice amount or the payment method; it’s about whether the person you’re paying is actually a contractor in the eyes of the law.

Get it wrong, and you’re not just facing a slap on the wrist. You’re looking at crippling fines, back taxes, and forced benefit payments that can easily sink a young company. I’ve seen founders get tangled in legal battles that last for years, all because they treated their "freelancer" a little too much like an employee.

You can call them a “consultant,” a “freelancer,” or a “ninja unicorn developer” in your contract—it really doesn’t matter. Tax authorities couldn’t care less about the title you’ve assigned. What they care about is the reality of the working relationship.

And it all boils down to one word: control.

Think about your relationship with your international talent. Do you:

If you answered yes to any of these, you need to pay close attention. You might be drifting into employee territory, even if they’re thousands of miles away.

Over the years, I’ve developed a quick mental checklist to keep my operations clean. Before I bring on any international contractor, I run through these questions. If the answers start getting murky, I know I need to restructure the agreement or reconsider the engagement entirely.

The line is simple if you think about it this way: An employee is part of your machine; you tell them how to operate it. A contractor is a specialist you hire to deliver a finished part for your machine; you don't tell them how to build it.

Getting this wrong is one of the most common ways businesses get into trouble. Government agencies like the IRS in the US have specific criteria they use, and they are not shy about enforcement. Uber famously paid $8.4 million to settle a misclassification case in California—a rounding error for them, but a death sentence for a startup.

If you find your working relationship looks more like employment, you might need a different solution. For companies that want to fully integrate a global team member without the legal headache of setting up a foreign entity, understanding what an Employer of Record is can be a game-changer. An EOR handles the local payroll, taxes, and benefits, keeping you compliant.

Ultimately, the goal is to maintain a clear, respectful, and legally sound boundary. Getting this right from day one saves you from the kind of legal drama nobody has time for.

Alright, let's get into the nitty-gritty. Not all payment methods are created equal, especially when you’re sending money across borders. Some are fast but will bleed your runway dry with fees, others are cheap but brutally slow, and a few are just dinosaurs waiting for the asteroid.

I’ve tried them all, lost money on hidden fees, and dealt with the panicked "Where's my payment?" Slack messages. So, you don't have to.

Let’s start with the one your corporate grandpa would recommend: the international bank wire, or SWIFT transfer. It feels safe, official, and utterly reliable. It’s also slow, expensive, and a complete black box once the money leaves your account.

Honestly? Just don’t.

A wire transfer is like sending a package through five different postal services, with each one taking a little peek inside and charging you for the privilege. You’ll pay a hefty fee upfront, then the intermediary banks will skim a little off the top, and finally, the recipient's bank might charge them to receive it. It’s a fee party, and you’re the unwilling host.

Next up are the household names: PayPal, Payoneer, and the like. Everyone has an account, which makes them incredibly convenient for one-off payments to a new contractor. The money moves fast—often in minutes—which is a huge plus.

But that convenience comes at a steep price. Their business model is built on currency conversion fees. You'll often see them advertise "low" transaction fees, but the real cost is hidden in the exchange rate they give you, which can be 3-4% worse than the real market rate. That's a silent killer for your margins.

PayPal is the convenience store of international payments. It's great when you're in a pinch and need something right now, but you wouldn't do your weekly grocery shopping there. The markup will eat you alive over time.

Think of it this way: on a $5,000 payment, a 3.5% FX spread costs you an extra $175. Do that monthly, and you've just paid for a new Aeron chair you'll never get to sit in.

This is where things get interesting. Companies like Wise (formerly TransferWise) burst onto the scene by exposing the dirty secret of hidden bank fees. Their model is simple: offer the real, mid-market exchange rate and charge a small, transparent fee on top. No mystery charges, no fluff.

For most startups paying a handful of contractors, this is the sweet spot. Traditional SWIFT bank transfers can take 3-5 days and rack up fees of $25-50 per transaction plus 2-4% FX spreads—which is just painful for regular payments. Wise, on the other hand, holds local bank accounts in dozens of countries, effectively turning an international transfer into a series of local ones. Research shows they can cut costs by as much as 80% compared to old-school banks. Read more about how payment methods stack up.

This approach isn’t just about saving money. It’s about respect. Data shows that 93% of contractors prefer to be paid in their local currency. It removes the guesswork and risk from their end, which builds immense trust and loyalty.

So, Wise is great. But what happens when you go from two international contractors to ten? Or twenty? Suddenly, you're not just sending money; you're managing contracts, collecting W-8BEN forms, tracking invoices, and praying you’re not accidentally misclassifying someone.

This is where dedicated contractor management platforms come in. Think of them as the operating system for your global team. They handle everything from onboarding and contract generation to payments and tax form collection in one place.

Yes, they have a subscription fee, but they solve a much bigger problem than just the payment itself. They automate the entire administrative workflow that you, the founder, would otherwise be doing manually at 11 PM on a Tuesday.

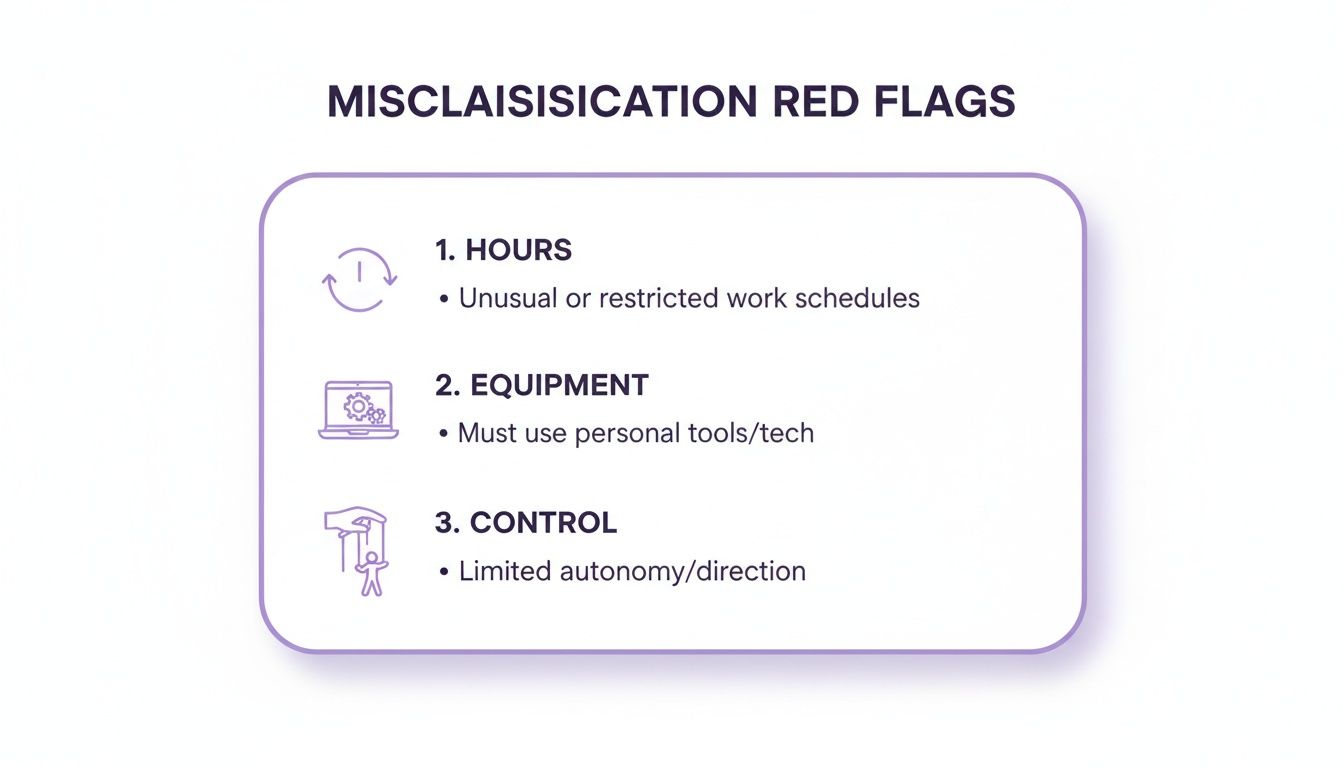

This infographic breaks down some of the key misclassification red flags that these platforms help you avoid.

As you can see, controlling hours, providing equipment, and dictating process are tripwires for misclassification—something a robust platform helps you document correctly from the start.

The real value here is time and peace of mind. You're no longer the bottleneck for payments or compliance. The system runs itself, ensuring everyone gets paid correctly and on time, every time, while keeping your legal ducks in a row. For any business serious about building a distributed team, this is the endgame. (Toot, toot! Yes, this is what we do at LatHire, and we’re shamelessly proud of it).

Choosing the right tool for the job is critical. To make it easier, I've put the top contenders head-to-head. Here’s how they stack up on what really matters: speed, cost, and practicality for a growing company.

| Payment Method | Average Speed | Typical Fees | Founder's Verdict |

|---|---|---|---|

| Bank Wires (SWIFT) | 3-5 business days | High ($25-50 wire fee + poor FX rates) | The dinosaur. Avoid unless you have no other choice. It's slow, expensive, and opaque. |

| Digital Wallets (PayPal) | Minutes to hours | Low upfront fee, but high hidden FX fees (3-4%) | The convenience trap. Great for a one-off payment in a pinch, but the costs add up fast on recurring payroll. |

| Fintech (Wise) | 1-2 business days | Transparent & low. Small fixed fee + mid-market FX rate. | The best bang for your buck for paying a few contractors. It’s cheap, fast, and honest. |

| All-in-One Platforms | 1-3 business days | Subscription or % fee (includes compliance, contracts, etc.) | The operating system. It’s not just a payment tool; it automates your entire global contractor workflow. Essential for scale. |

Ultimately, the right choice depends on your stage. If you're just starting with one or two contractors, a fintech solution like Wise is perfect. But once you start building a real distributed team, the administrative overhead of contracts, taxes, and compliance makes an all-in-one platform a non-negotiable investment.

A handshake deal might fly when you’re hiring a local freelancer for a weekend project, but it’s a massive liability when you’re navigating different legal systems, time zones, and currencies. Your contract is your first and last line of defense.

Forget those generic templates you find on Google. A weak contract is an open invitation for scope creep, payment disputes, and intellectual property headaches. Your goal is an agreement that's ironclad but doesn’t read like a phone book written by lawyers. The real aim here is radical clarity.

Putting a well-defined process in place is the ultimate preventative medicine. In my experience, it stops 99% of payment disputes before they ever start and ensures your professional relationships begin—and stay—on solid ground.

I’ve seen too many founders get burned by flimsy one-page agreements. Don't be that founder. Every international contractor agreement you sign must have these clauses, no exceptions. This isn’t just a "best practice"; it's essential self-preservation.

Here’s the bare minimum your contract needs to cover:

Think of your contract as the pre-flight checklist for your working relationship. It feels tedious upfront, but it’s what ensures you don’t crash and burn mid-project. Skipping a step because you’re in a hurry is just asking for trouble.

This isn’t about mistrust—it's about setting clear, professional boundaries from day one. A great contractor will appreciate the clarity because it protects them, too. It shows you’re a serious business that has its act together.

Once the contract is signed, the next critical piece is the invoice itself. A sloppy or incomplete invoice is a direct path to a delayed payment. You need a dead-simple process for your contractor to follow that gives your accounting team everything they need without a dozen follow-up emails.

Your contractor's invoice should always include:

This level of detail isn't just for you. It creates a clean, professional paper trail that protects both parties and makes everyone's life easier. When you standardize this process, you eliminate friction and get people paid faster. The best systems are the ones you set up once and then forget about because they just work.

Alright, let's talk about everyone's favorite topic: taxes. Specifically, the alphabet soup of forms the IRS loves to throw at you. It sounds painfully boring, I know, but getting this part right is what lets you sleep at night instead of having nightmares about audits.

If you’re a US-based company, there’s one form that should become your best friend when you pay international contractors: the W-8BEN (or the W-8BEN-E for businesses). Think of it as your get-out-of-jail-free card for tax withholding.

Getting this simple document from your non-US contractors is non-negotiable. It’s their official declaration to the IRS that they are not a US taxpayer. For you, it’s the proof you need to justify why you aren't withholding a chunk of their pay for Uncle Sam.

Without it, the IRS can assume the worst and may require you to withhold up to 30% of your contractor's earnings. Now, imagine having that conversation with a top-tier engineer you just hired. It's a relationship-killer.

So, how do you manage this without turning into a full-time compliance clerk? You build a dead-simple, repeatable system. This isn't legal advice, but it's the battle-tested workflow I've used for years to keep things clean and automated.

This isn’t rocket science. It's about having a process and sticking to it religiously. And if you need a more detailed breakdown of what goes into a compliant payroll system, our payroll compliance checklist covers all the bases.

Beyond IRS forms, remember that your contractor is navigating their own country's tax system. Making their life easier is a massive competitive advantage when it comes to attracting and retaining talent.

This is where paying in local currency becomes a game-changer. One study found that a staggering 93% of global workers prefer to be paid in their local currency. Why? Because they can lose 5-10% of their pay to terrible exchange rates and hidden bank fees. That’s a huge deal. You can explore more insights about global payments from McKinsey's report to see just how important localization is.

Your compliance duty doesn't end with collecting a form. It extends to creating a payment experience that is professional, respectful, and accounts for the realities your contractor faces. Paying them in their own currency is the easiest win you'll ever get.

The right payment platform can automate these localized payments and reduce admin work by up to 60%, all while keeping you on the right side of data privacy laws like GDPR and CCPA. But the stakes for getting it wrong are dangerously high, with potential fines reaching 20% of payroll in places like California or over €20,000 in France.

Ultimately, a good compliance strategy isn't about having an army of lawyers on standby. It’s about having a smart, automated system that handles the tedious stuff for you, letting you focus on building your business—not memorizing tax code.

In the early days, your international payment process is probably a beautiful mess. A patchwork of Wise transfers, shared Google Drive folders, and a master spreadsheet you pray never gets corrupted. It's scrappy, it's cheap, and for a little while, it actually works.

But that duct-taped system has a very real—and very low—ceiling.

There’s a clear tipping point where "scrappy" just becomes "sloppy." This is the moment you have to stop acting like a founder wearing all the hats and start thinking like a CEO building a scalable machine. The big question is, when do you finally pull the trigger on a real system?

It isn't about hitting a magic number of contractors. It's about when the administrative friction starts costing you more in time, risk, and headaches than a proper system would cost in dollars.

You’ll feel the growing pains long before they show up on a balance sheet. The first signal is usually your own sanity. Are you spending more than a few hours every month manually chasing invoices, hunting down W-8BENs, and triple-checking currency conversions? That's your first big red flag.

Here are the other signs that should be screaming, "It's time for an upgrade!":

As your global talent pool gets bigger, manually managing every payment becomes a huge bottleneck. This is when smart companies start looking at platforms that offer mass payout solutions to get back their time and reduce errors.

This is a common point of confusion for founders, so let's clear it up. They are not the same thing, and using the wrong one is like bringing a hammer to a software problem.

An EOR is for turning a specific contractor into a compliant, full-time employee. Think of it as a targeted solution for a single relationship you want to formalize and deepen.

A contractor management platform is for automating payments, contracts, and compliance for your entire freelance workforce. This is your operating system for managing a flexible, distributed team at scale.

Figuring out which one you need—or if you need both—is a critical strategic decision. If you're stuck trying to decide which path makes the most sense for your business, our guide to outsourcing payroll companies can offer some much-needed clarity.

The key is to recognize the moment your manual hustle stops being a badge of honor and starts becoming a bottleneck to growth. That’s your cue to invest in a real system.

Look, I get it. This stuff gets complicated, and sometimes you just need a straight answer without wading through a thousand words of legalese. Here are the quick, direct answers to the questions that probably keep you up at night.

You don't always have to, but you absolutely should. Seriously.

Paying someone in their local currency eliminates all the risk and hassle of conversion on their end. It's a massive, underrated factor in contractor retention because it shows respect and builds trust. Modern payment platforms make this so easy there’s really no excuse not to.

Easy one: misclassifying them. So many founders accidentally treat contractors like employees—dictating their hours, providing company equipment, and getting too involved in their day-to-day work.

This is a ticking time bomb for compliance. Getting it wrong can lead to crippling fines, back taxes, and forced reclassification by tax authorities. Always ensure your contract and your actual working relationship scream "independent."

This really comes down to what you both agree on, but monthly or bi-weekly is the standard rhythm.

The worst thing you can do is have an erratic, unpredictable payment schedule. Set clear terms in your contract (e.g., “payment will be issued within 15 days of invoice receipt”) and stick to it like your business depends on it—because it does. Happy contractors do great work.