Let’s be honest, nobody starts a company dreaming of calculating withholding taxes. The real benefits of outsourcing payroll go far beyond just saving time—they’re about reclaiming your focus, dodging costly compliance bullets, and eliminating the administrative drag that kills growth.

You launched your company to build something great, not to become an amateur accountant every two weeks. Yet, for many founders, in-house payroll is treated as the default, a scrappy rite of passage. But it’s not the default; it’s a deliberate choice with steep, often invisible, costs.

Think of it like building your own office furniture from scratch. Sure, you can do it, but is that really the best use of a CEO's time?

The real price you pay for DIY payroll isn't the software subscription. It’s the soft costs—the ones that actually hurt. It’s your lead developer's afternoon, torched while troubleshooting a glitchy API integration. It's the two hours you lose deciphering a cryptic state tax form instead of closing your next big deal.

This is the opportunity cost that drains momentum. Every minute spent on payroll is a minute not spent on product, sales, or strategy.

Your time is the one asset you can't get back in a Series A. Wasting it on administrative tasks you can easily offload is a strategic error, plain and simple.

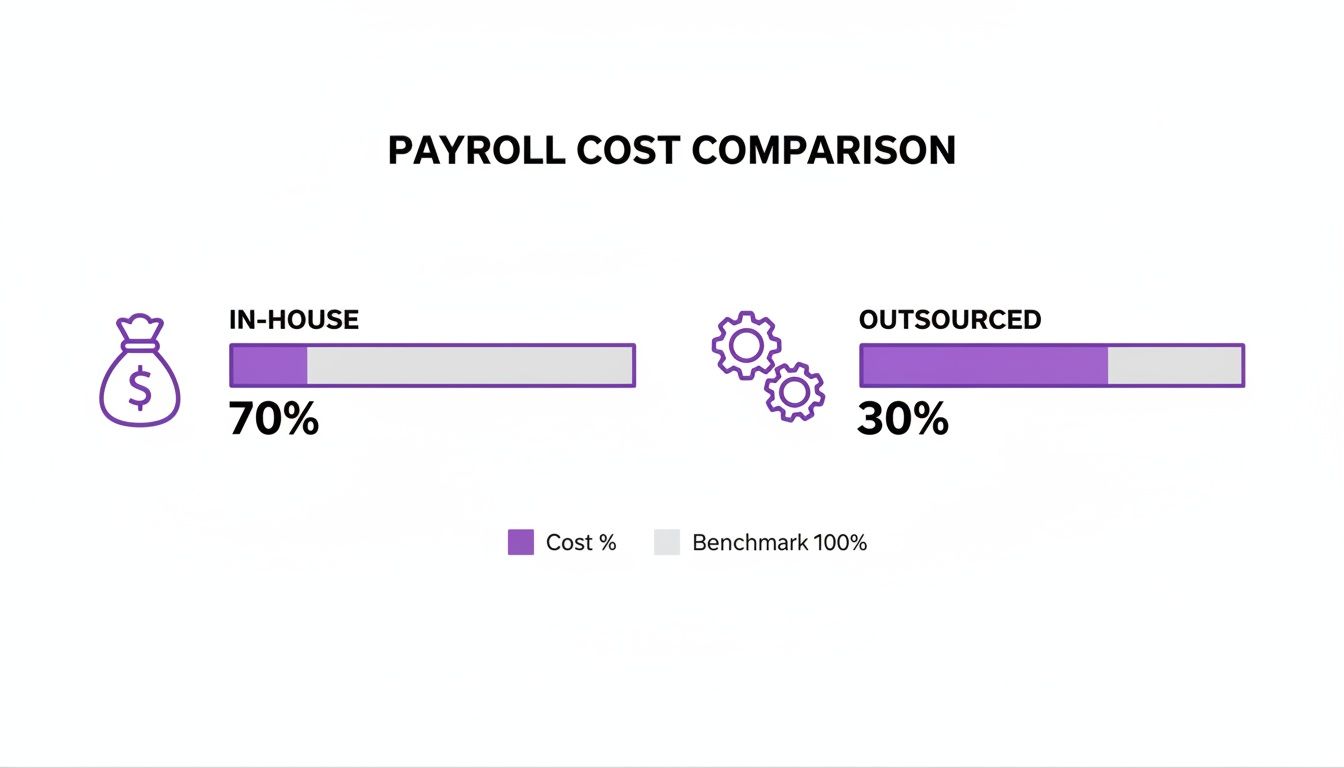

The global payroll outsourcing market is booming for a reason, projected to surge from USD 12.44 billion to USD 17.83 billion by 2031. Why? Because smart companies are waking up to the massive cost reductions. Businesses that outsource often see double-digit percentage drops in total processing costs, especially as they offload complex calculations. You can explore the full research on this market shift to see the data for yourself.

The chart below shows a simplified but realistic breakdown of where your payroll budget actually goes when you compare both approaches.

The visual makes it clear—the sticker price of a service is a fraction of the true internal cost of salaries, time, and risk.

When you crunch the numbers, the comparison isn't even close. Here’s a look at the explicit and hidden costs that stack up when you keep payroll in-house versus handing it over to the experts.

| Cost Factor | In-House Payroll (The DIY Trap) | Outsourced Payroll (The Smart Way) |

|---|---|---|

| Salaries & Benefits | Full-time salaries for payroll staff, plus benefits, training, and overhead. | A predictable, fixed monthly fee. No benefits, no overhead. |

| Software & IT | Costs for payroll software licenses, maintenance, updates, and IT support. | All-inclusive. The provider manages the tech stack. |

| Time & Opportunity | Hours lost by HR, finance, and even leadership on manual data entry and corrections. | Minimal time required from your team—just review and approve. |

| Training & Expertise | Ongoing costs to keep staff updated on ever-changing tax laws and regulations. | Included. You get access to a team of compliance experts. |

| Compliance & Penalties | High risk of fines and penalties from calculation errors or missed deadlines. You own 100% of the liability. | The provider assumes much of the liability for accuracy and timeliness, minimizing your risk. |

| Printing & Supplies | Costs for checks, envelopes, postage, and secure document storage. | Digital-first. Pay stubs and reports are delivered electronically. |

The table tells the story. The DIY approach nickels and dimes you with hidden expenses that go far beyond a simple software subscription. Outsourcing consolidates these into one clear, manageable cost, freeing up capital and mental energy for what truly matters: growing your business.

Time is the one asset you can't get back. So let’s be brutally honest about what “payroll day” really costs your company. It’s not just the three hours your finance lead spends triple-checking deductions. It’s the lost momentum that grinds a fast-moving business to a halt.

Every two weeks, key people are forced to switch from their real jobs to becoming amateur accountants. One minute you’re whiteboarding the next big product feature, the next you’re googling “state unemployment insurance rates.” This mental whiplash is exhausting, and it pulls your most valuable players out of their zone of genius.

Outsourcing payroll isn't about delegation; it's about buying back your most critical resource. It’s about making payroll an invisible process that just works in the background, freeing you up to focus on building the business.

Think about the real cost here. The average small business owner spends anywhere from five to ten hours per pay period on payroll-related tasks. That’s up to 20 hours a month gone. What could you accomplish with an extra 20 hours?

Could you close another client? Mentor a key employee? Finally get that pitch deck polished for the next round of funding? I'm betting the answer is a resounding yes.

And this isn't just a founder's problem. It’s a bottleneck that slows everyone down. Your head of operations, your HR manager—they all get pulled into the vortex. What starts as a "quick check" spirals into a full day of chasing down timesheets and verifying bank details.

The goal isn't to get better at running payroll. The goal is to make payroll irrelevant to your daily operations. You should just have to review and approve, then get back to work that actually matters.

This is exactly why the market is shifting so aggressively toward automated solutions. The efficiency gains are undeniable, with cloud-based platforms capturing 80.40% of the market and projected to hit USD 14.35 billion by 2031. For a growing company, this means you can access enterprise-level automation for a simple subscription fee—a massive competitive advantage. You can read the full research on payroll market trends to see just how profoundly automation is changing the game.

Let's break down what you're really losing. It's not just about the hours you log; it’s about the quality of those hours and the ripple effects across your organization.

Here’s a snapshot of where the time actually goes:

When you outsource, you don’t just hand off these tasks. You eliminate an entire category of work from your team's mental load. You're not just saving hours; you're reclaiming focus, reducing stress, and freeing up your best people to solve problems that actually grow the business. That’s a return on investment you can’t put a price on.

Let's talk about the least glamorous, most terrifying part of running a business: compliance. It’s a jungle of red tape, and it feels like it was designed to trip you up. One tiny miscalculation, one missed deadline, and suddenly you’re on the receiving end of a very unpleasant letter from a three-letter agency.

Trying to keep up with the alphabet soup of regulations—from the IRS and the Department of Labor to a dozen state-level bodies—is a full-time job. And it’s a job you probably don’t have time for. No offense.

These rules aren’t static, either. They shift constantly. New tax laws, updated withholding tables, and obscure local ordinances pop up overnight. Keeping track of it all yourself is like trying to patch a leaky boat with duct tape during a hurricane. Eventually, you’re going to sink.

A payroll error isn’t just an "oops." It’s a legal and financial liability that can spiral out of control. Think I'm being dramatic? The average IRS penalty for a payroll tax mistake can be staggering.

It's a major reason why North America commands 40.70% of the global payroll outsourcing market. Companies are practically sprinting to offload this risk. They know that navigating things like annual updates to Social Security wage bases is a minefield where a single misstep can cost thousands. You can discover more insights on why companies are outsourcing payroll risk on mordorintelligence.com.

You didn’t start a company to become an expert in Form 941 schedules. Handing compliance over to people who live and breathe this stuff isn’t weakness; it’s a brilliant strategic move. You're transferring the liability to a team whose entire business model depends on getting it right.

And this isn’t just about federal taxes. Every state has its own unique set of rules for things like:

Getting any of this wrong can trigger audits, penalties, and back-taxes that can cripple a growing business.

Now, let's take that compliance minefield and expand it across borders. Hiring internationally is one of the biggest competitive advantages you can have right now, but it also multiplies your compliance risk by a factor of ten.

Suddenly, you’re not just dealing with the IRS; you’re wrestling with foreign tax authorities, different labor laws, mandatory benefits, and multi-currency reporting. Trying to manage this in-house isn't just difficult—it's borderline impossible without a dedicated legal and finance team in every single country you operate in.

Hope you enjoy deciphering Brazilian labor laws or Mexican social security contributions, because that’s now your job.

This is where outsourcing becomes a no-brainer. An experienced global payroll partner doesn't just cut checks; they act as your compliance shield. They handle the messy details of cross-border regulations, ensuring every team member is paid accurately and legally, no matter their location. This isn't just about avoiding fines—it's about having the confidence to build a global team without getting buried in global bureaucracy.

Outsourcing payroll transforms compliance from your biggest risk into a solved problem. It frees you up to focus on growth, knowing an army of experts is handling the details that could otherwise sink your entire operation.

Let’s get real. Your next rockstar engineer probably isn't down the street. They might be in Bogotá, São Paulo, or Buenos Aires, ready to build the future of your company. Going global isn't just a trend; it's the single biggest competitive advantage you can get right now.

But there's a catch. International hiring comes with a monster of a bottleneck: international payroll.

Imagine the nightmare. You're trying to figure out multi-currency payments, deciphering tax laws you can't even read, and navigating labor regulations that make zero sense. Hope you enjoy spending your afternoons fact-checking international wire transfer codes and reading up on pension requirements in Chile—because that’s now your full-time job.

It’s an administrative black hole.

Hiring someone in another country without the right infrastructure is a recipe for disaster. Each new hire in a new country adds an entirely new layer of complexity. You’re not just paying a person; you’re wrestling with an entire country's legal and financial system.

Suddenly you’re asking questions like:

This is where most companies give up. They stick to their local talent pool, missing out on a world of skill and experience because the administrative pain is just too high. The benefits of outsourcing payroll are never clearer than when you decide to hire your first international team member.

Outsourcing isn't just about offloading tasks; it's about buying a ticket to the global talent market. It turns the complex, risky process of international hiring into something as simple as hiring someone in your own city.

And it’s not just a niche problem. For companies hiring globally, 33% use specialized payroll providers, often juggling two to five different vendors just to get decent coverage. The right integrated platform can slash these cross-border administrative headaches by up to 80%, making global collaboration seamless. You can learn more about how companies are standardizing global payroll on researchandmarkets.com.

Let’s be blunt about what it takes to manage international payroll yourself versus using an end-to-end partner. The difference is stark. It’s the difference between trying to build an airplane while flying it and stepping onto a private jet.

To see just how different the two paths are, take a look at the breakdown below.

| Task | DIY Approach (The Hard Way) | Partner Approach (The Smart Way) |

|---|---|---|

| Local Compliance | You research, interpret, and implement every country's specific labor and tax laws. Good luck. | Experts handle it. They ensure you're compliant with local regulations you've never even heard of. |

| Currency & Payments | You manage multiple bank accounts, deal with fluctuating exchange rates, and handle international wire fees. | One invoice, one payment. The partner handles all currency conversions and local bank deposits seamlessly. |

| Contracts & Benefits | You hire local lawyers to draft compliant employment contracts and find local benefits brokers. | Locally compliant contracts and competitive benefits packages are generated and managed for you. |

| Onboarding | A messy, manual process of collecting international documents and setting up payroll details across different systems. | A single, streamlined onboarding flow for every employee, regardless of their location. |

| Support | Your employee in Brazil has a pay question at 3 AM your time. You're on the hook. | Local, in-country support teams answer employee questions in their own language and time zone. |

The choice is pretty clear. One path leads to spreadsheets, sleepless nights, and legal risks. The other leads to a scalable, efficient global team. When you're ready to build a world-class team, you need a world-class system to support it. Our guide to global payroll services breaks down exactly how an integrated partner can remove this friction for you.

Let’s talk about two things that can make or break a growing company: security and scalability. They might sound like corporate jargon, but getting them wrong can bring your business to a screeching halt.

Think about it this way: is your intern's laptop really the best place to store your team's banking details and social security numbers? Because if you're running payroll on a spreadsheet, that’s pretty much what you’re doing. You’re one stolen backpack or one clever phishing email away from a catastrophic data breach.

When you manage payroll in-house, sensitive data often ends up scattered across emails, local hard drives, and unprotected spreadsheets. It’s a hacker’s dream. Your team is brilliant at what they do, but they aren’t cybersecurity experts.

A professional payroll provider, on the other hand, lives and breathes security. It’s their entire business.

They invest millions in safeguards you’ve likely never even considered:

Handing your payroll to a secure provider isn't about losing control. It's about admitting that a dedicated team of security pros can protect your most sensitive information better than a password-protected Excel file ever could.

This is more than just peace of mind. It’s about dodging a very real, very expensive bullet. A single data breach can cost you dearly in fines, legal fees, and—worst of all—the trust of your employees.

Now, let’s talk about growth. That scrappy, manual payroll system you hacked together for your first five hires feels efficient. It’s simple, it works, and you feel totally in control.

But that system doesn't scale. In fact, it's designed to break.

By the time you hit 15 employees, it becomes a major time-suck. At 50, it’s a full-blown crisis, drowning in errors and bottlenecks. And at 500? Forget about it. You’ll need to hire a full-time team just to manage the chaos.

This is the scalability trap. Your homegrown process becomes an anchor, slowing you down right when you need to be moving at top speed. Every new hire, especially an international one, adds a crushing weight of administrative complexity.

An outsourced solution, however, is built for scale from the ground up. Hiring one new person involves the same simple, streamlined process as hiring one hundred. The platform expands with you effortlessly, whether you're adding a developer in your city or a sales lead on another continent.

This is exactly why small and medium-sized businesses are driving the adoption of outsourcing, with a projected 9.58% annual growth rate in the market. It gives them access to enterprise-grade scalability without the crippling cost of building it themselves. You can find more details about this growth trend on mordorintelligence.com.

By outsourcing, you’re not just buying a service; you’re investing in an infrastructure built to support your ambition. It’s a strategic move that flips security and scalability from potential weaknesses into genuine competitive strengths, clearing the path for growth.

Alright, you’re convinced. Outsourcing is the smart play. But now comes the hard part—choosing a partner that won’t just become another vendor you have to manage. Picking the right payroll partner is less about features and more about finding an extension of your own team.

You’re not just buying software; you’re buying expertise, reliability, and peace of mind. Get this decision wrong, and you’ll trade one set of headaches for another. Let’s cut through the noise and focus on what actually matters.

Every sales demo looks perfect. Every website promises a seamless experience. Don’t fall for it. To find a partner that will actually help you grow, you need to be ruthless in your evaluation. Forget the marketing fluff and ask the hard questions.

Here’s my no-nonsense checklist, forged in the fires of startup trial-and-error (toot, toot!):

The single biggest differentiator is whether they offer a truly integrated platform. Are they just a payroll processor, or can they handle the entire employee lifecycle—from hiring and onboarding to compliance and benefits, all in one place? Juggling separate systems for hiring, HR, and payroll is a recipe for manual errors and wasted time.

To further understand the intricacies of payment processing and selecting knowledgeable partners, explore resources from leading payments experts who specialize in this domain. A true partner eliminates friction, not just moves it around.

The right platform doesn't just pay your people; it gives you the infrastructure to build a global team without the administrative drag. It removes the bottlenecks that prevent you from hiring the best talent, no matter where they live.

The future of work is borderless. Your ambition is global. Don't let your back-office systems hold you back. Choose a partner that gives you the tools to compete on a global stage, turning payroll from a tedious chore into a strategic advantage that fuels your growth.

Let's be honest, you've heard the sales pitch, but you still have questions. Every smart founder does. It's time to cut through the noise and get straight to the real-world answers for the things you’re actually worried about.

Here are the most common questions we hear from founders and HR leaders when they're thinking about outsourcing their payroll for the first time.

| Question | Short Answer |

|---|---|

| Isn't outsourcing too expensive for a startup? | No, it's almost always cheaper once you factor in your own time, potential fines, and the cost of hiring an in-house payroll specialist. |

| Will I lose control over my payroll process? | Not at all. You gain better control. You approve everything from a central dashboard but delegate the tedious execution. |

| How hard is it to switch to a provider? | A good partner makes it simple. They should handle the data migration and guide you through a structured, painless setup. |

| What's the difference between a simple payroll service and a global partner? | A simple service handles domestic payroll. A global partner (like an Employer of Record) manages the entire international hiring lifecycle. |

These are the quick takeaways, but let's dive into the details so you can see the full picture.

This is probably the biggest myth out there. Thinking outsourcing is too expensive is like asking if a fire extinguisher costs too much—you only realize the true cost of not having one after the building is already on fire.

When you factor in the cost of your own time (your most valuable asset), the salary of anyone helping you, and the very real risk of a $10,000 compliance fine for a single mistake, outsourcing almost always comes out cheaper. Good providers bundle their services at a scale you just can't match in-house, turning a dozen hidden costs into one predictable, manageable fee.

Nope. In fact, you actually gain better control. This isn't about blindly handing over your company’s bank details and just hoping for the best.

Modern payroll platforms give you a clean, simple dashboard where you review and approve everything before a single dollar moves. You maintain full visibility and always have the final say, but you get to delegate the soul-crushing, time-sucking execution to the experts. You're the pilot, not the person stuck shoveling coal in the engine room.

If a provider makes their onboarding process a nightmare, that’s a huge red flag—they’re the wrong partner. Reputable services have this down to a science.

They’ll typically handle the data migration and system setup for you, often with a dedicated person to walk you through it step-by-step. The entire process is designed to be painless. This principle holds true for any key business tool; for instance, when learning how to choose the best internal communications platform, a smooth and supportive setup is a great first signal of a quality partner.

This is a critical distinction to understand, especially if you plan to grow. A basic service is like a local taxi—it gets you around your home city just fine. They’ll handle your domestic tax calculations and direct deposits without any issue.

But a true global partner, often called an Employer of Record (EOR), is like your own private jet. They manage the entire international employment lifecycle for you. This includes everything from locally compliant contracts and benefits packages to handling complex taxes and payments in multiple currencies. They’re what makes hiring that genius developer in Brazil not just possible, but incredibly easy.