Let’s be honest. Your current background check method is a mess. It’s a Frankenstein's monster of slow email chains, questionable data sources, and a quiet prayer that the resume in your inbox isn't a work of creative fiction.

If you enjoy spending your afternoons fact-checking job histories and chasing down references—great. That’s now your full-time job. This old-school, manual approach was never built for a global, remote-first world. It’s slow, it’s expensive, and it’s riddled with blind spots the second you hire across borders.

A proper background verification process is your first and last line of defense against bad hires. It’s a structured investigation to make sure the person you’re bringing into your company is exactly who they say they are. It’s not about being suspicious; it’s about being smart.

A weak background check doesn't just slow you down; it exposes your company to risks you can't afford. We’re not talking about hiring someone who fudged their university degree. We're talking about tangible, expensive threats:

This isn't about ticking a compliance box. It’s about building a team you can trust without having to mortgage your office ping-pong table for a decent verification service. The market for these services is exploding for a reason. The global background check market is set to swell from $15.54 billion in 2024 to an anticipated $39.60 billion by 2032. Why? Because everyone's finally waking up to the risk. You can discover more about the market's rapid growth and what's driving it.

Let’s be clear: A background check isn't a "nice-to-have." It’s a core business function. Treating it as an afterthought is like building a house and hoping the foundation sorts itself out.

A modern background verification process is your most powerful tool for smarter, scalable hiring. It's what separates fast-growing companies from the ones constantly putting out fires started by a hire they never should have made. It’s time to stop hoping for the best and start verifying.

So, what really happens after you click ‘run check’? Spoiler: it’s not some magical Google search that spits out a perfect report. A proper background verification process is like peeling an onion—each layer reveals something new, and you need the whole story if you want to avoid tears later.

Think of it as a multi-layered investigation. Let’s break down the essential components so you know exactly what you’re paying for.

These are the absolute table stakes. Skipping any of these is like buying a car without checking if it has an engine. You’re just asking for trouble.

First up is Identity and Social Security Verification. Seems basic, right? You’d be surprised. This is the foundational, "Are you a real person?" check that confirms your candidate is who they claim to be and is legally eligible to work.

Next, Criminal Record Checks. Here’s an insider tip: a single “national” database is a myth. A real search pulls from multiple sources—county, state, and federal records. Anything less is just security theater. It won't tell you if you're hiring a financial wizard or someone who thinks "creative accounting" is a literal job description.

You're not just hiring a skill set; you're inviting someone into your company's inner circle. Verification isn't about distrust; it's about due diligence.

Then comes the real moment of truth: Employment and Education Verification. This is where most resume "creativity" gets exposed. Did they really manage a team of 20, or was it just one very stressed intern? Did they graduate summa cum laude, or just from the school of wishful thinking? This is where you find out.

To make it crystal clear, here’s a quick-glance table breaking down these core checks and what they actually reveal.

| Type of Check | What It Verifies | Why It Really Matters |

|---|---|---|

| Identity Verification | Candidate's legal name, date of birth, and Social Security Number. | Confirms they are who they say they are and can legally work. It's step one. |

| Criminal Record Search | Felonies, misdemeanors, and pending cases at local, state, and federal levels. | Protects your company, employees, and customers from potential harm or fraud. |

| Employment Verification | Job titles, dates of employment, and sometimes reason for leaving. | Catches embellished resumes and confirms their real-world experience. |

| Education Verification | Degrees, certifications, and attendance dates from accredited institutions. | Ensures their qualifications are legitimate, not fabricated. |

Each piece of this puzzle helps build a complete, trustworthy picture of the person you're about to bring onto your team.

The $500 Hello. That's what a bad hire can feel like. Specialized checks provide context that’s crucial for specific roles. Think of these as electives—not mandatory for everyone, but absolutely essential for certain career paths.

Navigating all these layers gets complicated fast, especially when you’re hiring across borders. The rules and privacy laws change dramatically from one country to another.

That's precisely why a deep understanding of international background check services is critical. Each check is designed to mitigate a specific risk, and knowing which ones to run is half the battle.

So you’ve mapped out the perfect background verification process. Now, let’s throw a giant wrench in those plans: international borders. This is where a perfectly good hiring strategy can die a slow, painful death by a thousand legal papercuts.

If you think you can use the same consent form for a developer in Dallas and another in Bogotá, think again. The rules for background checks in the U.S.—governed by the beast known as the Fair Credit Reporting Act (FCRA)—are worlds apart from the regulations in Brazil, Colombia, or Mexico. Welcome to the compliance maze.

Let's get one thing straight: a one-size-fits-all approach to international background checks isn’t just lazy; it’s legally reckless. Candidate consent is the bedrock of any ethical background verification process, but what "consent" actually means changes drastically the moment you cross a border.

In the U.S., the process is fairly standardized. But in Latin America? Not so much. Each country has its own mix of data privacy laws, many influenced by Europe's GDPR. This means what you can ask for, how you store the data, and how long you can keep it is different everywhere.

Trying to apply a U.S.-centric compliance model to a global team is like trying to use a house key to start a car. The tool is wrong, the context is wrong, and you’re going to break something expensive.

Ignoring these differences isn't just a minor slip-up. It can lead to five-figure fines, operational shutdowns, and a reputation for playing fast and loose with personal data. Not a great look when you're trying to attract elite global talent.

To stay on the right side of the law, you have to understand the local landscape. Don't think of it as a single game with one set of rules. It’s more like a tournament, with each event having its own playbook.

Here’s a taste of what you're up against:

This web of complexity is a major reason why the background check industry is booming. In the United States alone, the industry is on track to hit $5.1 billion in revenue by 2025. You can check out more insights on the background screening industry's growth to see how compliance is pushing the market.

And for roles that demand the highest level of scrutiny, like those requiring NATO SECRET Security Clearance processes, the rabbit hole goes even deeper.

It’s an intricate web, and navigating it requires local expertise. Without it, you're not just flying blind; you're flying directly into a storm. That’s why our guide on how to hire international employees emphasizes building a compliant process from day one. It’s the only way to build a global team without racking up a massive legal bill.

Let’s get one thing straight: a background check that comes back “clean” doesn’t automatically mean you’ve found the perfect hire. Not even close. The real skill is learning to read between the lines, because that’s where the expensive problems hide.

The obvious red flags are easy—a fraud conviction for a CFO candidate is a no-brainer. It's the quiet inconsistencies that often signal future trouble. This isn't about finding “bad” people. It's about identifying business risk and moving from a gut-feeling hire to a data-backed, defensible decision.

So, let’s talk about the patterns that should make you pause.

Anyone can spot a fake degree. The real art is in spotting the patterns that tell a bigger story.

Unexplained gaps between jobs? One short stint is a fluke; a string of six-month stays is a pattern. Did they claim they "led a team" when their official title was "individual contributor"? That’s an invitation to ask more questions. A single exaggeration might be nerves, but a resume full of them points to a character issue.

Think of it as a risk assessment, not a witch hunt. The key is to connect the findings to the actual demands of the job.

A background check isn’t a pass/fail test. It’s a data point. Your job is to analyze that data, understand its context, and assess the risk it poses to your business.

Ah, social media. The place where professional personas go to die. Screening has exploded, with usage surging by 47% between 2022 and 2024. But this is where you can get into serious legal trouble. Diving into a candidate's personal life without a clear framework is a terrible idea.

The goal isn’t to penalize someone for a bad joke they made in 2012. It’s to identify patterns of toxic behavior, hate speech, or public conduct that directly contradicts your company's values. You’re looking for poor judgment that could spill into the workplace, not an opinion you disagree with.

This trend extends beyond social feeds. As talent pools go global, OFAC sanctions searches grew by 46% in 2024—a critical step for compliance. You can discover more insights about these screening trends and how they reflect the new realities of hiring.

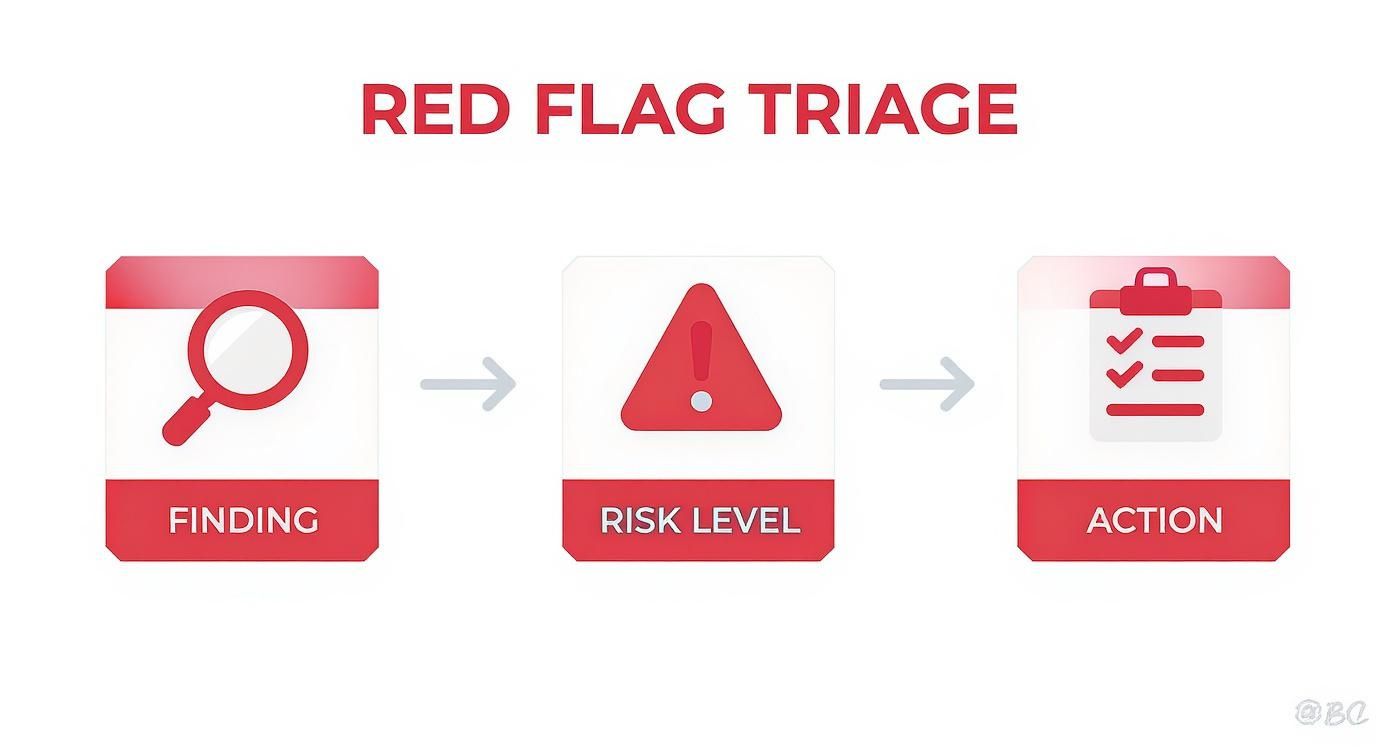

Okay, you've found a few yellow flags. Now what? You need a system. A risk matrix is a simple framework to help you make consistent, fair decisions. No more emotional calls or "I just have a bad feeling about this one."

It helps you triage findings based on their severity and relevance.

Here’s a quick guide for triaging common issues.

| Red Flag Finding | Potential Risk Level (Low/Medium/High) | Recommended Action |

|---|---|---|

| Minor Traffic Violation (Non-Driving Role) | Low | Document and dismiss. Not relevant. |

| Unexplained 3-Month Employment Gap | Medium | Discuss with the candidate to understand the context. |

| Exaggerated Job Title or Duties | Medium | Verify with references; assess if it's a minor embellishment or a material misrepresentation. |

| Criminal Conviction (Non-Violent, Unrelated) | Medium | Conduct an individualized assessment based on role, nature of offense, and time passed. |

| Falsified Degree or Certification | High | Usually a deal-breaker. Indicates a serious integrity issue. |

| History of Workplace Harassment | High | Poses a direct risk to team safety and culture. Typically disqualifying. |

| Recent Felony Conviction for Fraud (Finance Role) | High | Direct conflict with job responsibilities. Non-negotiable. |

This systematic approach keeps you objective and compliant. It transforms the background verification process from a simple check into a strategic risk management tool. And in an age of digital manipulation, it's crucial to know how to spot a deepfake when evaluating video interviews.

Ultimately, a strong process is supported by robust reference checks. To truly master this, check out our guide on how to conduct reference checks that actually deliver insights.

Alright, theory is great, but execution is everything. Let’s build a workflow that doesn’t feel like assembling IKEA furniture in the dark.

The goal isn't just to run checks. It's to weave them into your hiring process so seamlessly they become a strategic advantage, not a last-minute roadblock.

First things first: you need a standardized company policy. Don’t wing it. This is not the time for improv. Your policy is your rulebook. It's what keeps you consistent, defensible, and out of legal hot water.

This is where most companies drop the ball. They treat the background check like a secret interrogation. Big mistake. Top talent has options, and they won’t stick around if they feel like they’re being put through a suspicious ordeal.

Be upfront. Let candidates know a background check is a standard part of your process for all final-stage applicants. Frame it as a routine step to ensure a safe and trustworthy environment for everyone—which is the truth.

Candidates aren't just applying for a job; they're evaluating your company. A transparent, respectful verification process tells them you're organized and professional. A messy one tells them you're chaotic.

By communicating clearly, you manage expectations, reduce their anxiety, and lower the chances of a fantastic candidate dropping out because your process felt sketchy.

The biggest workflow mistake is treating verification as an isolated, final step. This creates a painful bottleneck. Instead, integrate the process directly into your hiring funnel.

Trigger the background check as soon as you extend a conditional offer. Not a week later. The moment the candidate says "yes," the verification should kick off automatically. This simple shift does two things:

The workflow below visualizes a simple but effective triage process for handling red flags.

This structured approach ensures that when a finding does pop up, you can assess its risk and take consistent action without derailing your entire hiring pipeline. It’s about designing a better process—one that’s fair, efficient, and protects your business without scaring off the very people you want to hire.

Alright, let's get right to it. You’ve got questions, and I’ve heard them all before—usually from a founder frantically trying to hire a key role. Here are the quick, no-nonsense answers.

It varies, and anyone who gives you a single number is oversimplifying. Old-school services can drag on for weeks. In this market, that's a deal-killer. Your star candidate will have three other offers by the time your report comes back.

A modern, tech-driven background verification process should take 3-5 business days, maximum. The secret is combining direct API access to digital databases with on-the-ground experts who can hustle. If a provider quotes you two weeks, they're not being thorough; they're just inefficient.

Thinking a background check is a one-size-fits-all product. The biggest—and most expensive—mistake is applying a standard U.S.-based check to a candidate in Mexico, Colombia, or Brazil. It's not just ineffective; it's a legal minefield.

This isn't like ordering a pizza with different toppings. You're ordering a completely different meal. Applying a U.S. check abroad means you’ll miss critical local records and probably violate a half-dozen privacy laws.

The cardinal sin is failing to tailor the verification to the specific country's regulations and data sources. It’s a lazy approach that creates a ton of risk for no reason.

Yes, but tread very, very carefully. In the U.S., the FCRA has strict "adverse action" rules. This means formally notifying the candidate of the findings and giving them a chance to dispute the information. You can't just ghost them.

In other regions, the rules differ, but the principle of fairness is universal. You need a clear, non-discriminatory policy that connects the findings directly to the job's essential functions. Was the issue truly relevant to the role, or are you just nitpicking?

Always—and I mean always—consult with legal counsel to make sure your decision-making process is compliant. A five-minute call with a lawyer is infinitely cheaper than a year-long wrongful termination lawsuit. Don’t learn this lesson the hard way.