So, you’re thinking about outsourcing payroll. Smart move. Outsourced payroll companies exist for one reason: to handle the soul-crushing admin of paychecks, taxes, and compliance so you don’t have to.

When your meticulously crafted spreadsheet starts looking like a Jackson Pollock painting and you're spending more time deciphering tax codes than talking to customers, it's time. You’re not just buying a service; you’re buying back your time and sanity.

Let’s be honest. Nobody launches a startup dreaming of filing quarterly reports. You had a vision, and it probably didn’t involve moonlighting as an accidental payroll clerk. But that's where so many of us end up.

That beautiful spreadsheet you built? It’s now a labyrinth of VLOOKUPs, one-off exceptions, and ominous color-coded warnings. What used to be a 30-minute task now eats your entire Tuesday, complete with that cold-sweat anxiety just before you hit "send" on the direct deposits.

Hope you enjoy spending your afternoons fact-checking timesheets—because that’s now your full-time job.

This isn't just about clawing back a few hours. It’s about recognizing when the DIY approach starts actively costing you money and sanity. The cracks almost always start to show in painfully predictable ways.

The classic founder mistake is valuing your time at zero. Every hour you spend wrestling with payroll is an hour you’re not spending on sales, product, or fundraising. It’s the most expensive "free" work you’ll ever do.

Before we dive into vendors, let's get brutally honest about the in-house reality. Founders consistently underestimate the true cost—both in time and money—of running payroll themselves. It's not just cutting checks; it's a minefield of hidden tasks and potential liabilities.

| Factor | In-House Payroll (The DIY Dream) | Outsourced Payroll (The 'Get Your Life Back' Option) |

|---|---|---|

| Time Investment | 10-20+ hours/month. Data entry, tax calcs, issue resolution, and pretending you're a legal expert. | 1-2 hours/month. Approve hours, review reports, done. Go have a coffee. |

| Direct Costs | Software fees ($50-$200+/mo), your time (the biggest hidden cost), plus potential accountant fees to fix your mistakes. | Predictable monthly fee per employee. No surprise invoices. |

| Compliance Risk | Entirely on you. Miss a deadline or botch a tax calculation, and the fines are your problem. Ouch. | Shared liability. The provider is on the hook for accurate calculations and timely filings. They handle the risk. |

| Scalability | Painful. Each new state or country adds an exponential layer of complexity you don't have time for. | Seamless. Adding an employee in a new location is as simple as adding them to the platform. The provider does the hard stuff. |

| Expertise | Limited to what you know. You have to become the expert on everything from local taxes to benefits deductions. | Access to a team of actual experts. You have specialists on call to handle the weird questions about compliance and taxes. |

The table makes it pretty clear. While the DIY route might seem cheaper on the surface, the hidden costs in time, stress, and risk add up incredibly fast. Outsourcing isn't an expense; it's an investment in efficiency and peace of mind.

This isn’t a sign of failure. It's a sign of growth. More companies are realizing that managing payroll in-house is like trying to build your own office furniture—sure, you can do it, but why would you?

The global payroll outsourcing market is on track to hit USD 16.87 billion by 2030, a surge driven by businesses like yours that want enterprise-level tools without the enterprise-level headcount. You can dive deeper into the market trends to see why everyone's jumping ship.

Choosing to partner with one of the many outsource payroll companies isn’t just about offloading a task. It’s a strategic move to reclaim your focus and shield your business from risks you shouldn't be taking. It's about trading a recurring headache for predictable peace of mind.

So, you’ve finally admitted that your payroll spreadsheet is a ticking time bomb. Good. Now for the fun part: picking a partner from a sea of outsource payroll companies, all promising a friction-free paradise.

Spoiler alert: it’s a minefield of slick demos and pricing models designed by escape room artists. You’re not just buying software; you’re handing over the keys to one of your most critical business functions. Get it wrong, and you're signing up for a world of pain. Get it right, and you’ll wonder why you ever did it yourself.

The first trap you’ll stumble into is the “global coverage” claim. Every provider’s website has a beautiful world map dotted with flags, suggesting a seamless, unified operation across the globe.

The reality? Often a clunky patchwork of third-party contractors they’ve loosely partnered with. This isn't just a branding fib; it has real consequences.

When a payroll issue pops up for your new hire in Argentina, are you talking to a direct employee of your provider? Or are you playing a painful game of telephone with a local accounting firm that doesn’t know you from Adam?

Demand to know their operational model. Ask them directly:

Don't let them wave you off with vague talk about a "robust global network." Dig until you get a straight answer. Adopting these essential IT vendor management best practices is a great way to frame your questions.

Let's be blunt: a payroll data breach isn't just an IT headache; it's a potential company-killer. You're handing over your team’s most sensitive personal information—social security numbers, bank details, home addresses. A weak link here is completely unacceptable.

Don’t settle for a bullet point on a sales deck that just says "bank-level security." That means nothing. You need proof.

Look for certifications like SOC 2 Type II and GDPR compliance. These aren't just fancy acronyms; they are independent, third-party audits that verify a company’s security controls over time. If a provider can’t produce these, it's a massive red flag. Walk away.

This is not the place to cut corners. One breach will destroy employee trust and could bury you in regulatory fines. A vendor who takes this seriously will be proud to show you their credentials.

Finally, let's talk about money. Most outsource payroll companies lure you in with a simple per-employee-per-month (PEPM) fee. But the sticker price is rarely the final price. The real cost is hiding in the fine print, ready to ambush your budget.

I’ve seen them all. Beware the "gotcha" fees that turn a cheap service into an expensive nightmare:

Demand a full fee schedule upfront. Ask them to outline every single potential charge outside of the base rate. A trustworthy partner will be transparent. If they hedge or get cagey, you have your answer. Move on.

Sales demos are theater. Every slick UI and confident answer is the result of hundreds of hours of practice, designed to make you feel comfortable signing on the dotted line.

But you're not buying a feeling; you're buying an operational partner. Your job is to get off-script and ask the questions they really hope you won’t.

Welcome to the interrogation. This isn't about being difficult; it's about being diligent. You need to cut through the polish and see how these outsource payroll companies actually function when things get messy.

Anyone can give you a quote. A real partner can walk you through their failure modes without flinching. Forget "What's your pricing?" for a moment and start asking questions that test their infrastructure and expertise.

I’ve learned the hard way that the most telling answers come from the most specific, scenario-based questions. Try these on for size in your next demo:

These questions don't have simple yes/no answers. They force the sales rep to expose their actual operational workflows. You'll quickly see who has a battle-tested process versus who is just winging it.

A Request for Proposal (RFP) sounds corporate and stuffy, but it’s just a way to make vendors compete on your terms. It forces them to answer the same pointed questions, making it ridiculously easy to compare them apples-to-apples.

This eliminates the song and dance. A good RFP is less about features and more about processes and proof. Here are the core pillars to build it around:

Once the RFPs come back, you need an objective way to score them. A simple scorecard prevents you from being swayed by a charismatic salesperson and keeps you focused on what actually matters.

The Founder's Takeaway: Don’t grade features; grade outcomes. A "beautiful dashboard" is worthless if the support behind it is a ghost. A low price is a trap if it comes with slow, inaccurate service. Focus on reliability, expertise, and support.

Here’s a sample framework to get you started. Grade each provider on a scale of 1-5:

| Criteria | Vendor A Score | Vendor B Score | Notes |

|---|---|---|---|

| Regional Expertise (LatAm) | 4 | 2 | Vendor A has owned entities; Vendor B uses partners. |

| Support Model & SLAs | 3 | 5 | Vendor B offers a dedicated manager with a 2-hour response time. |

| Platform Usability | 5 | 3 | Vendor A's UI is cleaner, but B's reporting is more robust. |

| Pricing Transparency | 2 | 5 | Vendor A has hidden fees for off-cycle runs. |

| Integration Capabilities | 4 | 4 | Both integrate with our core accounting software. |

This process strips away the sales pitch and leaves you with hard data. It’s the difference between hoping you chose the right partner and knowing you did. And in the world of payroll, knowing is everything.

You signed the contract. The sales team sent a celebratory GIF, and for a fleeting moment, you felt a wave of relief. Don’t get too comfortable—the easy part is over.

A botched onboarding can poison the well for months, creating distrust with your team and making you question the whole decision. It’s where slick promises meet operational reality. Get this wrong, and that first outsourced pay run will feel less like a celebration and more like a catastrophe.

Here’s the first mistake most founders make: they think the process begins with the first official call. Wrong. The real work starts the moment you sign.

Your number one job is to clean your data. I’m talking about that messy spreadsheet with inconsistent date formats, missing employee details, and cryptic notes in the margins. Your new provider’s system is only as good as the data you feed it.

Garbage in, garbage out. It’s that simple. Before you hand anything over, you need to:

This isn't fun, but it's non-negotiable. Doing this grunt work upfront can shave weeks off your implementation timeline and prevent countless headaches.

Once your data is clean, the real sprint begins. You’ll be introduced to an implementation specialist—your new best friend (or worst enemy) for the next several weeks.

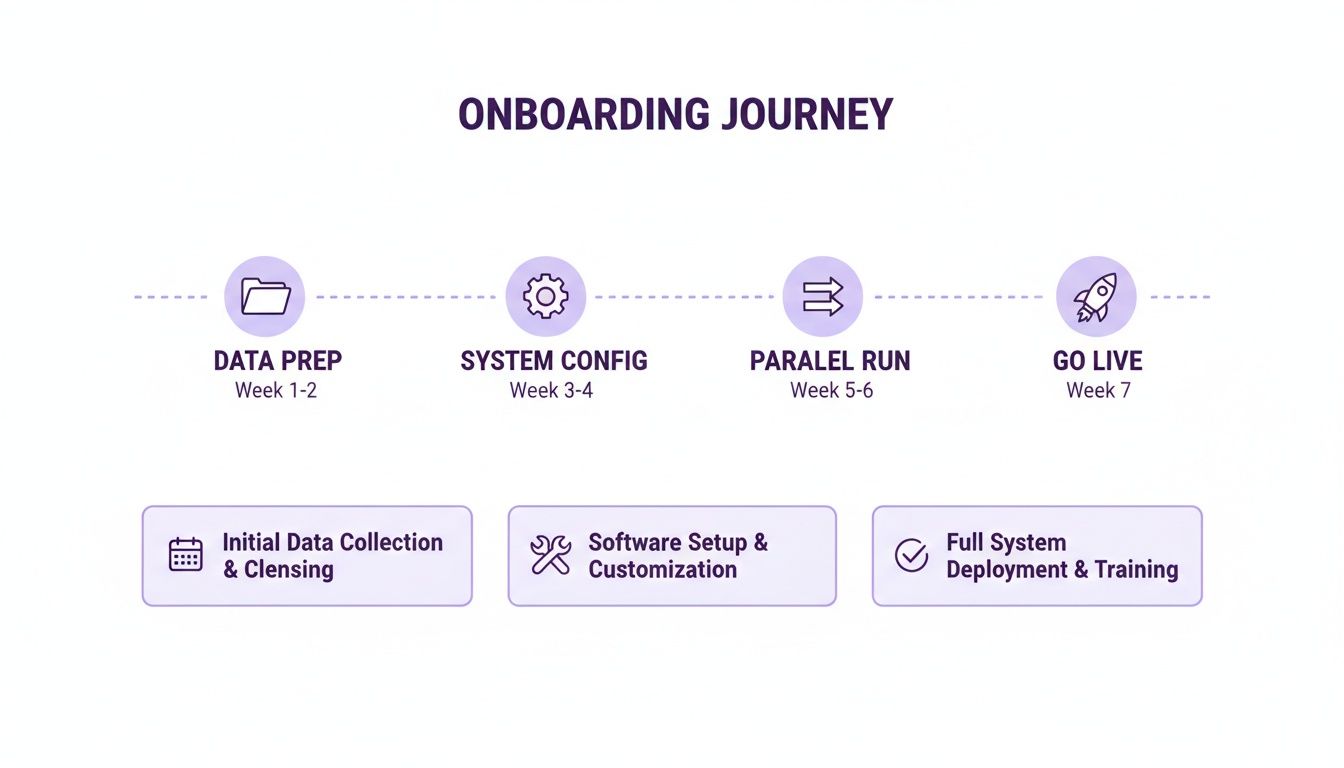

The entire process is a delicate dance between data migration, system configuration, and team communication. This infographic shows the typical four-phase journey.

This timeline highlights that the "Go Live" rocket launch is the final, shortest step, built on the critical foundation of diligent preparation and testing.

A key phase here is the parallel pay run. This is your dress rehearsal. Your new provider runs your payroll in their system while you still run it in your old one. You then compare the outputs line by line to catch any discrepancies before it affects real money.

Do not, under any circumstances, skip the parallel run. Ever. This is the single most important safety check in the entire process. Any provider that suggests you can bypass it to "save time" is waving a giant red flag.

Managing this transition has gotten exponentially harder. Remote and hybrid work models are now the norm for 81% of companies, which multiplies the compliance variables. Suddenly, you're not just onboarding a team in one office; you're managing tax rules for employees scattered across different states or even countries.

Communicating these changes to your team is just as important as the technical setup. An email a week before payday saying "Hey, your payslip looks different now" is a recipe for panic. Get ahead of it. For a deeper dive, check out our guide on effectively onboarding remote workers to maintain trust and clarity.

Onboarding with a top payroll provider shouldn't feel like a second full-time job. It’s an intense, front-loaded effort that pays dividends for years. Clean your data, demand a parallel run, and communicate clearly. It’s how you ensure the sprint to your first pay run ends with a victory lap, not a face-plant.

Enough theory. Let's get specific. If you’re like us, you’re targeting the absolute goldmine of talent in Latin America. And that, my friend, is a completely different ball game.

Hiring in LatAm comes with its own unique playbook. You're navigating wildly diverse labor laws, complex benefits expectations, and cultural nuances that generic "global" platforms completely miss. This is where most outsourcing payroll companies fall flat on their face.

So, let's get opinionated. We’ve been in the trenches, testing and vetting providers specifically for this region. This isn't a sponsored post. It’s a battle-tested perspective on who gets it right and who just puts a Colombian flag on their homepage. (Toot, toot!)

Before naming names, let's be clear on what we're judging. When you’re paying a developer in Brazil, your priorities shift dramatically. A slick UI is nice, but it’s worthless if your provider can’t handle the aguinaldo (the legally mandated 13th-month bonus) correctly.

Here’s what we grade on:

The biggest mistake we see is companies choosing a big-name US or European provider that treats LatAm as an afterthought. You end up with a system that’s great at US taxes but completely clueless about Mexico’s IMSS contributions. It’s a recipe for compliance disasters.

As you build your shortlist, it's also smart to get a handle on the broader mechanics of international payments. Exploring these effective methods for paying international contractors will give you a fuller picture of what's happening behind the scenes.

Alright, let's put some of the top players under the microscope. This isn't an exhaustive list, but it reflects the common archetypes you'll encounter. We’ve anonymized them to keep things constructive, but the profiles are based on real-world providers we've personally tested. This is the kind of scorecard that cuts through the marketing fluff.

| Provider | LatAm Coverage & Compliance | Integration & UX | Pricing Model | Founder's Verdict |

|---|---|---|---|---|

| Vendor A ("The Global Giant") | Patchy. Owns entities in Brazil/Mexico, but uses partners elsewhere. Compliance advice is often generic. | Slick but shallow. Beautiful interface, but configuring country-specific benefits is a nightmare. | Deceptive. Low PEPM fee, but charges extra for off-cycle payments and detailed reporting. | Avoid for LatAm focus. Great for simple, multi-country payroll but lacks the deep regional expertise needed for serious hiring. |

| Vendor B ("The LatAm Specialist") | Exceptional. Owns entities in 10+ key LatAm countries. Their compliance team is proactive, flagging regulatory changes. | Functional, not fancy. The UI won't win design awards, but it works. Integrations are solid but limited. | Transparent. A clear, all-in PEPM fee. No surprises for year-end filings or corrections. | Our top pick for dedicated LatAm teams. They sacrifice UI polish for unbeatable local expertise and support. They speak your language and your team's. |

| Vendor C ("The All-in-One HRIS") | Average. Covers major markets but struggles with smaller countries. Compliance feels more like a checklist than true advisory. | Excellent. A unified platform for HR, payroll, and benefits. Great employee self-service portal. | Premium. You pay for the integrated suite. Can be pricey if you only need payroll. | Good for US companies expanding lightly into LatAm. If your center of gravity is the US, the all-in-one approach is convenient. But it's not for a LatAm-first strategy. |

This scorecard proves the "best" choice isn't always the biggest or the prettiest. For us, Vendor B’s deep, focused expertise makes it the clear winner for any company serious about building a significant team in Latin America. They understand the landscape because it's their entire business, not just a section of their world map.

You’ve sat through the demos, read the guides, and probably have a spreadsheet comparing features you didn't even know existed six weeks ago. But the real questions—the ones that keep you up at night—usually pop up right after the sales rep logs off.

Let’s get straight to it. These are the unfiltered answers to the questions every founder asks.

The sticker price is just the hello. The "real" cost of partnering with outsource payroll companies is the base fee plus a bunch of potential extras they hope you don't ask about.

Your true cost includes the per-employee-per-month (PEPM) fee, sure. But you need to become a detective, scouting for hidden charges. Ask them to put it in writing:

A transparent provider won’t flinch at these questions. They'll give you a clear, all-in cost breakdown.

The biggest cost, however, is the one you’re already paying: the cost of not outsourcing. Factor in the hours you waste, the strategic drag of focusing on admin instead of growth, and the five-figure penalty you might face for one compliance mistake. A good partner saves you more than their fee costs.

Anyone who tells you the switch takes "just a few days" is selling you a fantasy, probably from a beach they bought with their commission checks. Let’s be realistic.

For a small business with a straightforward setup, you're looking at 4 to 8 weeks. This gives you enough time for proper data gathering, system configuration, bank verifications, and—most importantly—running at least one parallel payroll.

If you’re managing an international team, budget for 8 to 12 weeks. Rushing implementation is the number one cause of post-launch disasters, so build in a buffer. Your future self will thank you.

No, and you should run from any provider that makes you feel like you will. This isn't a black box you throw data into and hope for the best. You're outsourcing the tedious work, not your oversight.

Modern outsource payroll companies act as your co-pilot. You should demand full visibility through a dashboard to preview every payroll, pull reports whenever you want, and manage employee data in real-time.

You’re handing off the repetitive, high-risk tasks so you can focus on the bigger picture. You're the architect; they're the expert builders making sure the foundation is solid.

Easy. Focusing solely on price while ignoring the quality of customer support and depth of their compliance expertise.

Choosing the cheapest platform is a classic rookie mistake. That budget provider with chatbot-only support becomes incredibly expensive the moment you have a real problem, like a tax notice from a foreign government or a critical payment error. Suddenly, saving $10 per employee a month seems like a terrible trade-off.

During your vetting, be relentless. Probe their support model. Do you get a dedicated manager who knows your account, or are you just another ticket in a queue? What are their guaranteed response times? Ask them point-blank.

The best providers are service companies powered by technology, not the other way around. Sacrificing service for a few dollars is a short-term win that almost always leads to long-term pain. Don't fall for it.