A payroll outsourcing company is a third-party service that handles everything involved in paying your people—calculating wages, withholding taxes, and making sure you’re following all the rules. For a startup, it's the difference between shipping your next feature and spending a weekend deciphering state-specific tax forms. We learned that the hard way.

No one starts a company because they're passionate about becoming a part-time accountant. My co-founder and I were completely immersed in product development, running on cheap coffee and the conviction that we were building something important. Payroll was an afterthought, a "simple" spreadsheet we knocked out in an hour.

How hard could it really be?

Famous last words, right? That spreadsheet became a monster. At first, it was just salaries. Then we brought on a contractor. Then someone needed a different pay cycle. Before we knew it, we were wrestling with a multi-tab beast held together by fragile VLOOKUPs and sheer hope. One broken formula, one misplaced decimal, and the whole house of cards could come crashing down.

The real moment of truth arrived in a crisp, official-looking envelope. It was a polite letter from the tax authorities, a gentle reminder that they have very specific rules about payroll deductions. It wasn't a massive fine, but it was enough to make us sweat. The true cost wasn't the penalty fee; it was the two full days my co-founder—our lead engineer—spent on the phone instead of writing code.

That’s when it really clicks. The true cost of DIY payroll isn’t just your time. It’s the opportunity cost of your best people getting bogged down in low-value, high-risk administrative work. It’s founder burnout disguised as a line item on a budget.

We were sacrificing our product roadmap to save a few bucks on a proper system. It was a terrible trade-off. That sinking feeling that you’ve missed something critical, something a professional would have caught instantly, is a unique kind of startup pain. We started searching for a payroll outsource company that same afternoon.

The risks go way beyond simple calculation mistakes. The classic startup blunders are like a minefield just waiting for you to take a wrong step.

When you're trying to scale, these aren't just administrative chores; they are serious business risks. Grappling with these complexities is what pushes most founders to look into dedicated payroll services from specialized providers. Our experience certainly pushed us down that path. That spreadsheet monster? We gleefully deleted it and never looked back.

Once you finally admit defeat to the payroll spreadsheet monster, you’re tossed into a jungle of vendors. They all flash shiny dashboards and whisper sweet nothings about "peace of mind." Spoiler alert: it's rarely that simple. Choosing a payroll partner feels less like shopping and more like a high-stakes poker game where you don't even know all the rules.

You're not just picking software. You're entrusting a company with your team's livelihood and your own legal standing. If you mess this up, you’re right back where you started—drowning in administrative headaches, but now you’re paying for the privilege.

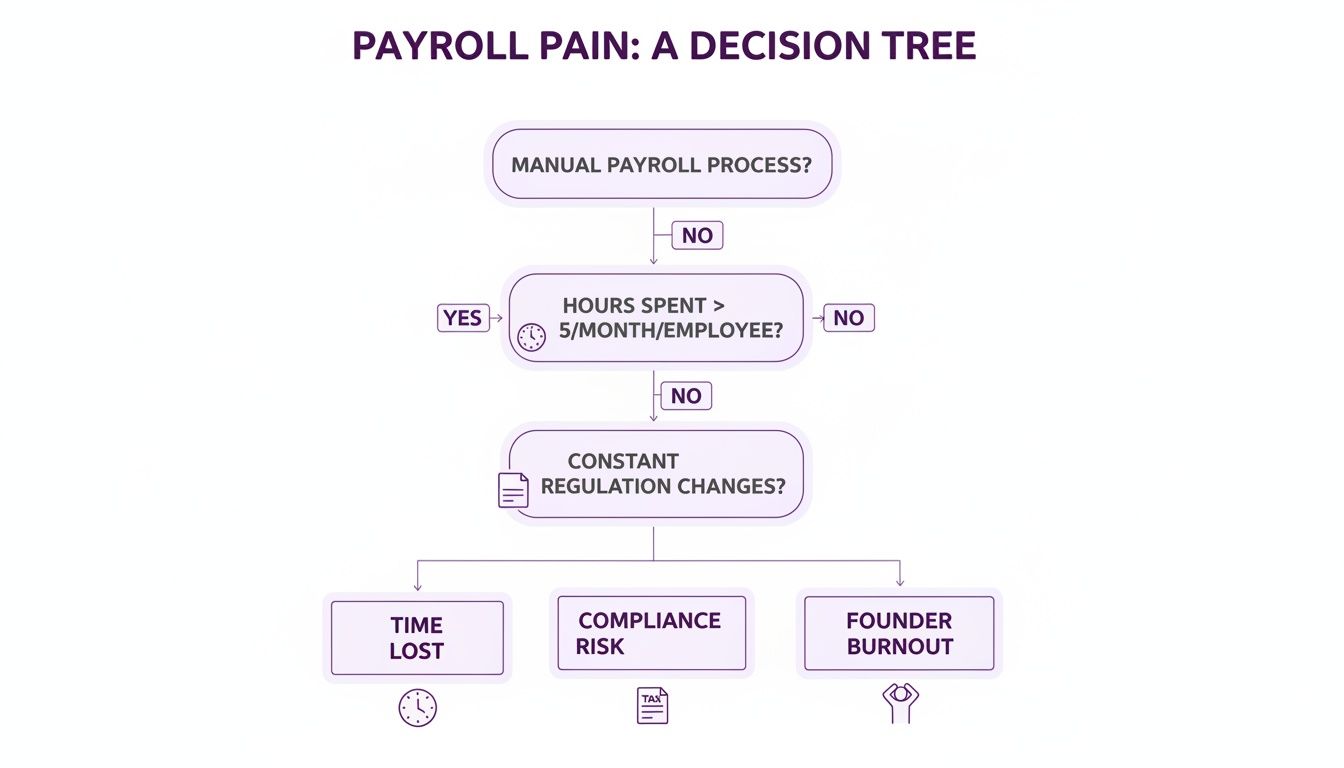

The decision tree below maps out the real costs of DIY payroll, from lost time to compliance risks, that usually force a founder's hand.

This really just shows the slippery slope from minor time sinks to major burnout. It’s a perfect illustration of why finding the right partner becomes a critical business decision, not just an administrative one.

First, you need to understand who’s even in the ring. The market for payroll outsourcing is booming, and for good reason—it’s projected to hit USD 16.87 billion by 2030 as more businesses flee from manual errors and compliance nightmares. But not every player offers the same game. You can learn more about the evolving payroll landscape in this in-depth market analysis.

Let’s break down the main types of partners you'll run into.

This table is a quick-and-dirty comparison of the main types of payroll outsourcing partners. It’s designed to help you figure out which model actually fits your company's stage and hiring needs right now.

| Partner Type | Best For | The Catch |

|---|---|---|

| Basic Payroll Provider | Domestic teams with simple needs. You handle HR, benefits, and compliance yourself. | They do only payroll. You're still on the hook for everything else. |

| PEO (Professional Employer Organization) | Gaining access to better benefits for U.S.-based teams through a co-employment model. | Often expensive overkill for small teams. You still need a legal entity everywhere you hire. |

| EOR (Employer of Record) | Essential for hiring internationally without setting up your own legal entities abroad. | The most comprehensive (and often costly) option, but non-negotiable for global teams. |

Sales demos are designed to hide the flaws. To find a true partner, you have to ask the questions they’d rather not answer. Forget the feature list for a second and focus on what actually matters.

The best payroll outsourcing company for a 500-person corporation is almost certainly the wrong one for a 15-person startup. Your goal isn’t to find the 'best' provider—it’s to find the one that’s best for you, right now.

Here's my battle-tested checklist:

Choosing the right partner is a strategic decision that gives you back your most valuable asset: time. Don’t let a slick sales pitch rob you of it.

The sales demo is a work of art. The dashboard is clean, the clicks are seamless, and the salesperson assures you that "peace of mind" is just one signed contract away. If only it were that simple. We’ve sat through enough of these polished presentations to know the real story often begins after you’ve signed on the dotted line.

This is the part of the guide where we get a little cynical, but for your own good. Think of this as giving you x-ray vision to see through the marketing fluff and spot the landmines before you step on them. Because choosing the wrong payroll outsourcing company can create more chaos than it solves.

Let’s start with the money because that’s where the first surprises usually hide. A low per-employee-per-month (PEPM) fee looks great on a proposal, but it’s often just the tip of the iceberg.

You need to become an expert interrogator about their pricing structure. Is it a flat fee? A percentage of your total payroll? Or some arcane combination of the two that requires a math degree to decipher? Each model has its place, but a lack of clarity is a massive red flag.

The most common trap is what I call the '$500 Hello.' It’s that initial, non-refundable setup and implementation fee they casually mention after you’ve already emotionally committed. Suddenly, you're hundreds or even thousands of dollars in the hole before you’ve run a single paycheck.

Here are the hidden costs to explicitly ask about:

The second major red flag is the software itself. During the demo, you see a slick, modern interface. But once you’re a customer, you might be relegated to a clunky, outdated portal that looks like it was designed in 1998. If the employee-facing side of the platform is confusing, you haven't outsourced your payroll problems—you've just become your team's new IT help desk.

Then there's the customer support, or lack thereof. It's easy to promise great service; it's much harder to deliver it when a payroll run is failing on a Thursday afternoon.

What happens when you have an urgent problem?

A payroll crisis is not the time to discover your partner’s support team is a ghost. Test them during the trial period. Send them a complicated question and see what kind of answer you get, and how quickly you get it.

This is the most dangerous red flag of all, especially for companies with remote or international teams. Many payroll providers claim they have nationwide or even global coverage, but their expertise can be deceptively thin. They might be rock-solid on federal law but completely clueless about a specific municipal tax in Denver.

Even worse is the international angle. A provider might be great at handling payroll in Texas but have absolutely no idea how to deal with mandatory 13th-month pay in Brazil. These aren't minor details; they are major compliance risks.

Before you sign anything, get specific. Don't just ask, "Do you handle international payroll?" Ask, "Can you walk me through the process of onboarding, paying, and ensuring full compliance for an employee in Bogotá, Colombia?" If they can't give you a confident, detailed answer, they can't solve your problem. They'll just create a bigger one.

So, you want to hire the best talent on the planet, regardless of their zip code? Good for you. Welcome to the final boss level of payroll: international compliance.

This isn’t about simple currency conversions. It's a full-blown minefield of local labor laws, mandatory benefits, and tax structures that make your domestic payroll look like a lemonade stand.

Trying to manage this on a spreadsheet is like trying to navigate a foreign city without a map, and the map is written in a language you don’t speak. This is the moment you stop looking for just any payroll outsourcing company and start looking for a specialist.

Here’s the hard truth: your trusty domestic payroll provider is probably useless here. They might be wizards with state taxes, but they will give you a blank stare when you mention "Aguinaldo."

What’s that? It's the mandatory 13th-month salary paid in many Latin American countries.

Miss that payment, and you’re not just dealing with an unhappy employee; you're facing serious legal penalties in a country where you have zero legal presence. This isn't a simple oversight; it's a critical compliance failure. And that's just one example.

This is where the conversation shifts from a simple payroll provider to an Employer of Record (EOR). An EOR is your legal shield. They become the official, on-the-ground employer for your talent in countries where you don't have a legal entity.

Think of it this way: you find the amazing developer in Colombia. The EOR hires them legally in Colombia, puts them on their locally compliant payroll, manages all their taxes and benefits according to Colombian law, and then that developer works exclusively for you.

You get all the benefits of having a global team member without the multi-million-dollar headache of setting up a foreign subsidiary. The EOR absorbs the legal risk, and you get to focus on building your business.

This model is non-negotiable for any serious attempt at international hiring. The EOR handles the entire local lifecycle, from generating a compliant employment contract to processing their final paycheck correctly.

Let's say you've found the perfect UX designer in Brazil. Instead of spending months and a fortune on lawyers to set up a Brazilian entity, a platform with a built-in EOR handles it all.

They generate a contract that respects Brazil's unique labor laws. They enroll the designer in the mandatory FGTS (unemployment insurance) and INSS (social security) programs. When payday comes, the designer receives their salary in Brazilian Reals, with all the correct deductions, on time.

You've just onboarded top-tier international talent without ever having to read a single page of Brazilian tax code. That’s not just outsourcing payroll; it’s outsourcing the entire operational and legal burden of global employment.

For companies looking to tap into talent pools like Latin America, this is the only sane way to operate. Platforms that specialize in these regions can provide you with comprehensive global payroll services that make this complex process feel surprisingly simple.

Alright, you’ve picked your new payroll partner. You sat through the demos, sidestepped the sneaky fees, and now you’re ready for that promised land of automated, error-free payroll.

Now for the really fun part: migrating everything without messing up someone’s paycheck.

This is where even the best-laid plans can fall apart. The transition is a delicate dance, and one wrong move can evaporate all the trust you’ve painstakingly built with your team. We’ve been through this migration minefield before and have the scars to prove it. Here’s our in-the-trenches guide to getting it right.

Before you even think about kicking off the onboarding with your new provider, you need to become a data squirrel. Your new partner is going to need a mountain of information, and having it all ready before they ask is the single best thing you can do for a smooth switch.

It’s tedious, yes, but it’s completely non-negotiable. Scrambling for this info mid-process is exactly how deadlines get blown and mistakes creep in.

Get this stuff gathered now:

Here’s the single most important piece of advice you’ll get: for the first month, run payroll with both your old and new providers simultaneously. Yes, it’s a pain. Yes, it might cost a little extra. But it’s the ultimate safety net.

Think of this "parallel payroll" as your live-fire test. It lets you compare the net pay, taxes, and deductions from both systems side-by-side before a single dollar actually moves.

We caught a half-dozen tiny errors during our first parallel run—a misconfigured local tax, a wrong benefits deduction, an incorrect overtime calculation. Finding those before payday turned a potential crisis into a simple data fix. It’s the cheapest insurance policy you’ll ever buy.

If the numbers don't match down to the last cent, you’ve found a problem. This is your chance to fix it without your team ever knowing something was amiss. Don't skip this step. Seriously.

Let's be honest: people get nervous when you mess with their money. Announcing a change in payroll can trigger a wave of anxiety if you handle it badly. The key is to be proactive, clear, and completely transparent.

Don’t just fire off a generic email saying, “We’re switching payroll providers.” That’s a recipe for a dozen panicked Slack messages.

Instead, frame it as a clear upgrade that benefits them.

Before you pop the champagne, there’s one last thing to verify. Does your shiny new payroll system actually play nice with your other tools? Or are you about to sign yourself up for a lifetime of manually exporting and uploading CSV files?

A seamless workflow is non-negotiable. Your payroll provider should integrate cleanly with your:

If these systems don't connect, you haven't outsourced a problem; you've just created a new, mind-numbing data entry job for yourself. True peace of mind comes when your systems work together, not when you’re the human glue holding them all together.

Alright, let's wrap this up with a few common questions I get from other founders who are sick of being part-time accountants. No fluff, just the straight answers you need, based on our own chaotic journey from spreadsheet hell to sanity.

Honestly? Sooner than you think. The common advice is "the moment you hire your first employee who isn't a founder." That’s not wrong, but I’ll be more direct.

The real answer is the second payroll starts taking up more than a couple of hours of your time per month. Or the instant you consider hiring someone in a different state, let alone a different country. Payroll complexity doesn't scale nicely; it explodes.

The cost of one mistake—in fines, back taxes, or wasted engineering hours fixing it—is almost always higher than the monthly fee for a decent payroll service. Don't wait for a scary-looking letter from the tax authorities to force your hand.

Absolutely, and this is a super common setup for domestic teams. You can hire a payroll outsourcing company to be your "mechanic"—they handle the calculations, the tax remittances, and the direct deposits. Meanwhile, you and your team still own the human side: hiring, onboarding, performance reviews, and company culture.

The big exception here is international hiring. If you're using an Employer of Record (EOR) to hire someone in, say, Mexico, the EOR handles both HR compliance and payroll for that person. They have to, because they are the legal employer in that country.

So, for a U.S.-only team? Splitting is easy. For a global team? They’re often bundled together for critical compliance reasons.

This is the million-dollar question, and getting it wrong is expensive. Let’s cut through the jargon.

A PEO (Professional Employer Organization) co-employs your staff. Think of it as a partnership. You still need to have your own legal business entity registered in the state or country where your employee lives. They mostly help U.S. companies get better benefits.

An EOR (Employer of Record) becomes the full legal employer for your team member in a country where you have no legal entity. They handle everything from the local employment contract to benefits and taxes.

I wish there were a simple answer, but the pricing is all over the map, which is incredibly frustrating. It’s like asking how much a car costs—are we talking about a used sedan or a new Ferrari?

Here’s a rough breakdown from what we’ve seen:

Your job is to demand a transparent, all-inclusive quote. Specifically ask about the nickel-and-dime fees for setup, off-cycle payments, and year-end tax forms. Never assume anything is included.