Let's be real. You didn't start a company because you had a burning passion for calculating payroll taxes. A payroll outsourcing agency is the specialist crew you bring in to handle the soul-crushing admin of paying your people, managing taxes, and staying on the right side of the law. Think of them as the expert plumbers for your company's financial pipes, freeing you up to actually build your vision.

You had a great idea. It probably involved a game-changing product, a cult-like customer following, and maybe even a decent espresso machine in the breakroom. What it definitely didn't involve was spending your Friday nights hunched over withholding tables trying to decipher cryptic government forms.

And yet, here we are. Payroll, which seemed so simple with one employee, has quietly morphed into a monster that eats your time, energy, and sanity. It starts small—a spreadsheet, a few direct deposits. Then you hire in another state. Then another. Suddenly you're juggling different tax laws, benefits deductions, and the constant, nagging fear that one tiny mistake could trigger an audit from hell.

This isn't just about the hours you lose; it's about the mental real estate it occupies. Every minute you spend double-checking direct deposit numbers is a minute you're not spending on strategy, talking to customers, or dreaming up your next big move. It's the ultimate, unglamorous distraction.

Hope you enjoy fact-checking timesheets and running reports, because that’s now your second job. This administrative quicksand pulls you further and further away from the very activities that, you know, make money.

The real cost of handling payroll yourself isn't the software subscription. It’s the opportunity cost—the deals you didn't close, the product features you didn't ship, and the strategy you didn't set because you were too busy playing accountant.

You might think your homespun system is working "just fine." But in business, "fine" is how you end up with compliance penalties that could have funded your entire marketing budget for a quarter. Tax codes and labor laws change constantly, and pleading ignorance to the IRS is a famously ineffective strategy.

For any growing business, especially one with ambitions beyond a single zip code, managing this complexity in-house is like deciding to build your own servers instead of just using AWS. It’s a noble idea, but a strategically terrible one. You're trying to solve a problem that experts have already perfected.

Hiring a payroll outsourcing agency isn't admitting defeat. It's a strategic decision to fire yourself from a job you never wanted and get back to doing what actually moves the needle.

Alright, let's get real about what a payroll outsourcing agency does. Forget the idea of a simple number-crunching service that just cuts checks. That's like saying a chef "just heats up food."

Think of it this way: you could try to be your own general contractor, electrician, and plumber when building a house. Or, you could hire specialized crews who know what they’re doing. A payroll agency is that crew for the complex, high-stakes foundation of your business finances.

They step in and take the entire chaotic mess of payroll completely off your plate. This isn't just about moving money. It’s about managing a tangled web of tax laws, compliance rules, and reporting requirements that you really don’t have time to become an expert in.

There's a reason payroll is the most commonly outsourced HR function. Founders are catching on that their energy is better spent growing the business, not getting lost in tax withholding tables. These HR outsourcing trends show just how mainstream this move has become. It’s not a secret anymore.

So, what are you actually buying? Far more than a payment processor. A good agency manages the endless details that cause the biggest headaches and the costliest mistakes.

Their main job is to build a professional fortress around your payroll process. This shields you from expensive errors, compliance fines, and the administrative quicksand that can swallow your week. You’re essentially swapping out your "hope this is right" spreadsheet for their "we guarantee this is right" system. Toot, toot!

Handing off payroll isn’t about losing control. It's about gaining precision. You're swapping a manual, error-prone process for an automated, expert-managed one.

Let’s break down exactly what they take over. When you bring in a payroll outsourcing agency, you’re buying back your time by delegating these mission-critical—and mind-numbingly boring—tasks:

In short, they become the engine room of your payroll operations. This frees you up to stay on the bridge and steer the ship, instead of being stuck below deck patching leaks.

Let’s talk about the iceberg lurking beneath your in-house payroll. On the surface, it’s just a few hours a month and a software subscription. But the real costs—the ones that can sink a growing business—are hidden deep below.

This isn’t just about saving a bit of time. It's about reclaiming your company from the jaws of administrative quicksand. The true cost of not using a payroll outsourcing agency is measured in sleepless nights, missed opportunities, and the constant, low-grade anxiety that you’ve messed up a tax filing.

Hope you enjoy reading dense legal documents, because every time a labor law changes, you're on the hook. One misplaced decimal on a tax form or a miscalculation of overtime can trigger penalties that make your eyes water. The government, as it turns out, is not very forgiving of "oops" moments.

These aren't hypothetical boogeymen. Businesses get hit with massive fines for mistakes that seem tiny at the time. Suddenly, that money you’d earmarked for a new hire is being sent off to cover a penalty, all because you were too busy running your actual business to become a part-time compliance lawyer.

Need a hand staying on top of the rules? Our payroll compliance checklist is a good place to start (and to scare yourself straight).

Now, let's talk hard numbers. Your in-house payroll isn't just the cost of your software. It’s a financial vampire with a dozen tiny teeth.

When evaluating the financial implications, considering broader market insights to manage people-related costs shows how outsourcing can optimize more than just payroll. You quickly realize you're not saving money; you're just spending it in ways that are harder to track.

This is a familiar story for many businesses. Let's put it side-by-side.

| Factor | In-House Payroll (The Hidden Costs) | Payroll Outsourcing Agency (The Value) |

|---|---|---|

| Direct Costs | Software fees, staff salaries, training, bank fees. A slow, painful bleed. | A predictable, all-inclusive monthly or per-employee fee. |

| Compliance Risk | You bear 100% of the liability for errors, penalties, and fines. Good luck. | The agency assumes the risk and manages compliance updates for you. |

| Time & Productivity | Hours lost to data entry, troubleshooting, and tax filings. Soul-crushing. | Frees up your team to focus on revenue-generating activities. |

| Scalability | Adding employees means more complexity, more training, and more mistakes. | Effortlessly scales with your business; add new hires without adding workload. |

The takeaway is clear: while in-house payroll feels cheaper, the hidden expenses in time, risk, and lost opportunity tell a very different story. Outsourcing turns an unpredictable cost center into a strategic asset.

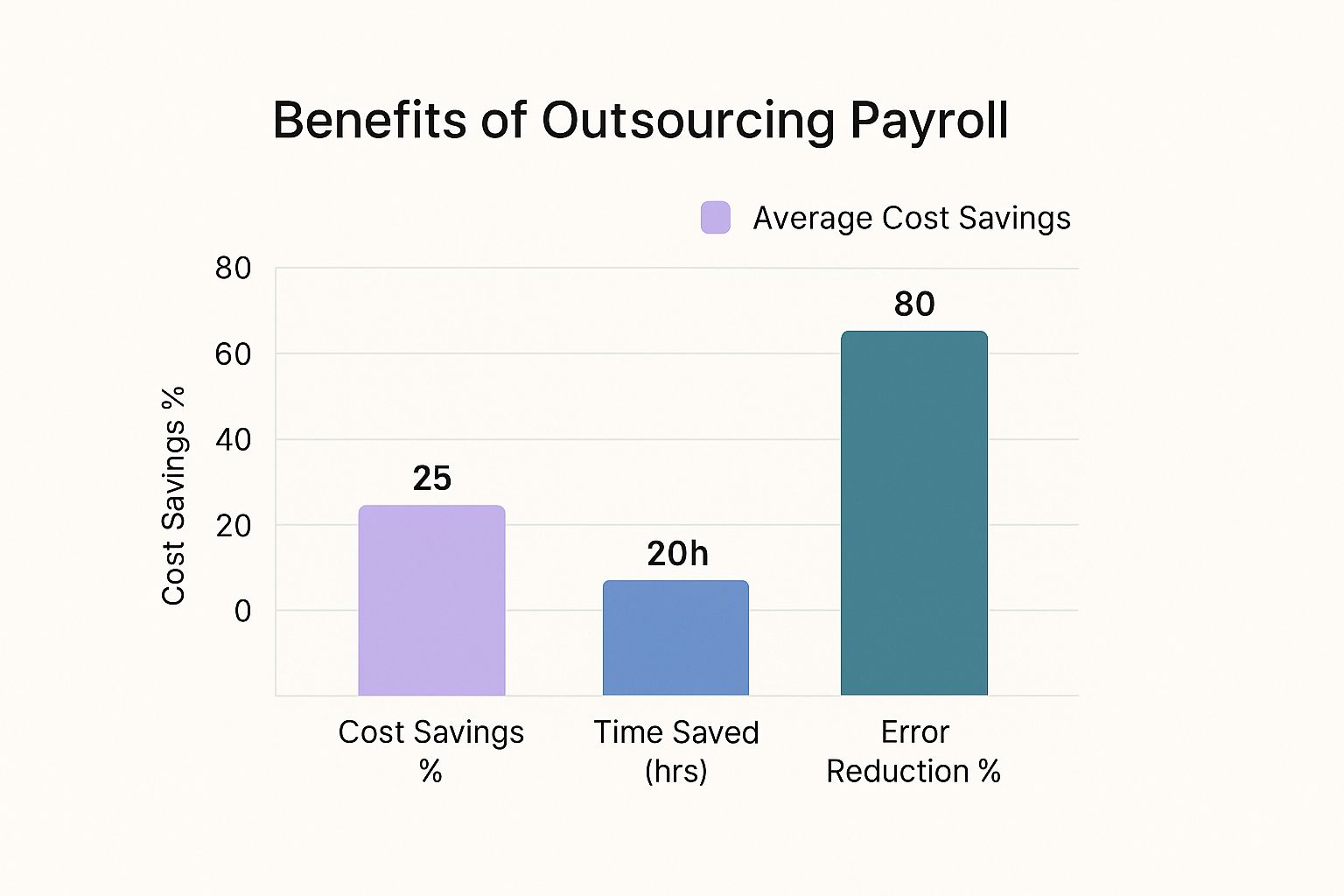

The data speaks for itself—outsourcing delivers significant savings while dramatically reducing the error rates that destroy team morale.

Here’s the biggest cost of all: lost focus. Every brain cycle your team spends on administrative tasks is a cycle not spent on building products, talking to customers, or generating revenue.

Getting payroll right is table stakes; it doesn't win you any new business. Getting it wrong, however, can be catastrophic. About 25% of employees report receiving paychecks with mistakes. The fallout is severe, as 49% of employees say they would start looking for a new job after just two payroll errors. Yikes.

Outsourcing your payroll isn't just about delegation. It's about surgically removing a low-value, high-risk function from your company so you can pour that reclaimed energy into growth. It's the smartest growth hack you're not using yet.

Let's get one thing straight: not all payroll agencies are created equal. Some are genuine partners who will save your sanity, while others are just glorified calculators running on software from 2005. Choosing the wrong one is like hiring a demolition crew to fix a leaky faucet—expensive, messy, and you still have a leak.

The market is flooded with providers who promise the world but deliver a clunky interface and a phone tree that leads to nowhere. They’re happy to process your payments, but when a real problem crops up, good luck getting a straight answer.

So, how do you spot the difference? How do you find a payroll outsourcing agency that’s a true partner, not just another line item on your expense report? You have to kick the tires and look under the hood.

I've been through this process more times than I care to admit, and I’ve learned to ask the tough questions upfront. Forget the slick sales pitch. Focus on what actually matters when you’re in the trenches.

One of the biggest gotchas in this industry is the pricing model. Some providers lure you in with a low base fee, then nickel-and-dime you into oblivion.

Beware the “à la carte” pricing menu. Suddenly, you’re paying extra for year-end tax forms, off-cycle pay runs, or even just to get a custom report. A transparent partner offers clear, all-inclusive pricing. No surprises.

They’ll also try to sell you their "one-size-fits-all" package, which really means "one-size-fits-them." Your business is unique; you need a solution that can adapt as you grow, add employees, or expand into new territories. A rigid platform that can’t scale with you is a liability, not an asset.

When you're ready to dig deeper, exploring how to select the right payroll outsource company can give you an even clearer framework for your decision.

Ultimately, you’re not just buying software; you’re buying expertise and peace of mind. The best agencies act as an extension of your team. They proactively flag potential compliance issues, offer strategic advice, and genuinely care about getting it right.

A good processor just moves money. A great partner helps you sleep at night. They understand that payroll isn't just a transaction; it's the bedrock of trust between you and your team. And they treat it with the seriousness it deserves.

Choose the provider who’s as obsessed with accuracy as you are. That’s the partner who will help you scale. Don't settle.

So, you did it. You hired your first international employee. Pop the cheap champagne! It feels like a massive win, a sign your company is hitting the big leagues.

Then Monday rolls around. You get an email about a "statutory social contribution" from a country you can't find on a map without zooming in. Suddenly, you’re drowning in a sea of unfamiliar acronyms, complex tax treaties, and compliance nightmares that make your domestic payroll look like a coloring book.

This is the exact moment when most DIY payroll systems—and the founders who rely on them—completely fall apart. Global expansion is the ultimate stress test for any payroll setup, and it's a test most are destined to fail.

Managing payroll in one country is a headache. Managing it across two, three, or ten? That’s a full-blown migraine. Each country has its own rulebook, and they didn’t bother to consult each other when they wrote them.

You’re not just dealing with different tax rates. You're facing a labyrinth of:

Turns out there’s more than one way to burn through your funding without mortgaging the office ping-pong table.

It’s no surprise that as companies expand their global footprint, their appetite for managing payroll internally vanishes. The numbers tell the story: only 31% of companies with operations in 2 to 5 countries keep payroll in-house. That number plummets to just 19% for those in 6 to 10 countries. You can read more about how global complexity drives payroll decisions and see why this trend is accelerating.

The question isn't whether your spreadsheet can handle global payroll. It's whether you can handle the fallout when it inevitably fails. A specialized payroll outsourcing agency is the only sane answer.

If you have any global ambitions—even just one employee in another country—a generic payroll processor won't cut it. You need a partner who lives and breathes international compliance. One that can protect you from the landmines you don’t even know exist yet.

Trying to navigate this minefield on your own isn’t just risky; it’s a strategic blunder. You should be focused on integrating your new global talent, not becoming an amateur expert on Portuguese labor law.

Alright, you’ve made the call. You’re firing yourself from the unpaid, thankless job of being a part-time payroll clerk. Smart move. But making the decision is one thing; pulling it off without causing a three-alarm fire is another.

A messy transition is the stuff of founder nightmares. It’s where employees get paid late, taxes get misfiled, and you start wondering if that spreadsheet was so bad after all. (Spoiler: it was.) But a smooth handover requires a plan, not just wishful thinking.

Think of it like moving to a new office. You don’t just show up on day one and hope the internet works. You need a plan to pack the boxes, label everything, and make sure the lights are on before anyone arrives.

Before you can hand over the keys, you need to get your house in order. Your new payroll outsourcing agency is good, but they’re not mind readers. They need clean, accurate data to get started. Don't be the client who dumps a shoebox full of crumpled receipts and expects magic.

This initial data gathering is the most labor-intensive part of the whole process. Get this right, and everything else gets easier.

Here's what you'll need to pull together:

Your transition will only be as smooth as the data you provide. Garbage in, garbage out. Take the time to organize your records now, and you’ll save yourself a world of pain later.

Once the data is ready, the fun begins. A competent agency will guide you through this, but knowing the roadmap helps. A realistic timeline is usually between two to four weeks, depending on your company's complexity.

The most critical step is the parallel pay run. This is your safety net. For one or two pay cycles, you'll run your old system alongside the new one. You’re not paying people twice; you’re just comparing the outputs to make sure every number, deduction, and tax calculation matches perfectly. It’s tedious, but it’s how you catch errors before they impact your team.

Finally, a word on communication. Don’t let the first time your team hears about this change be a weird-looking new pay stub. Send out a clear, simple email explaining the switch. Frame it as a positive step—it ensures they get paid accurately and on time, every time. For companies with a global workforce, clear communication is even more crucial. You can learn more about managing this process with our guide to global payroll services.

Alright, let's cut to the chase and tackle the questions bouncing around in your head. No fluff, just straight answers.

This is the big one, isn't it? A reputable agency doesn't just say "oops." They have an error guarantee. If they mess up a tax filing and you get hit with a penalty, they pay for it.

It’s that simple. Their entire business model rests on being more accurate than you could ever be, so they have serious skin in the game. This isn't just a service; it's a liability shield.

You’re handing over the keys to the kingdom—employee bank details, tax IDs, salary information. It’s a valid concern. Any agency worth its salt uses bank-level security with multi-layered encryption.

Think of it this way: their security infrastructure is almost certainly more robust than yours. They have entire teams dedicated to fending off cyber threats, while you're busy trying to remember your password. Ask for their security certifications (like SOC 2 compliance); if they can't produce them, run.

Handing your data to a top-tier payroll agency is like moving your cash from a shoebox under your bed to a vault at Fort Knox. One is clearly the smarter move.

Ah, the classic "gotcha." Some old-school providers love to lure you in with a low base fee, then hammer you with extra charges for things that should be standard.

Here’s what to watch out for:

A transparent partner offers a clear, all-in-one price. If their pricing sheet looks like a complex cell phone bill, it’s a red flag. The best payroll outsourcing agency provides predictable costs so you can actually budget, not just guess.