More and more, companies aren't just shifting benefits management to external partners to save a little time—it’s becoming a core strategy for tackling tricky regulations and skyrocketing costs. When you outsource employee benefits administration, you're essentially bringing in a specialized provider to handle everything from health insurance and retirement plans to compliance and employee questions. This frees up your in-house HR team to finally focus on the bigger picture.

The choice to hand off benefits management is rarely about fixing one small problem. It's a strategic move in a world where benefits are more critical—and more complex—than ever before. In-house HR teams, especially in small to mid-sized businesses, are often stretched to their limits, trying to balance daily admin tasks with the monumental job of keeping up with constantly changing laws.

This is where the true value of outsourcing really shines. You're not just offloading a to-do list; you're gaining a dedicated partner armed with deep expertise and powerful technology.

To see the difference clearly, let's break down the two approaches.

The table below offers a straightforward look at how managing benefits internally stacks up against partnering with an external provider. It highlights key differences in everything from cost structure to compliance risk.

| Aspect | In-House Administration | Outsourced Administration |

|---|---|---|

| Expertise | Relies on internal HR generalists. | Access to a dedicated team of benefits specialists. |

| Compliance | High risk; keeping up with ACA, COBRA, ERISA is a major burden. | Low risk; provider's core business is staying current with all regulations. |

| Cost | High overhead: salaries, benefits, training for HR staff. | Predictable, often lower, costs through a subscription or fee-based model. |

| Technology | Often requires separate, costly software investments (HRIS, payroll). | Access to a sophisticated, integrated technology platform is included. |

| Employee Experience | Can be slow and manual, with HR as the bottleneck for questions. | Streamlined, self-service portals empower employees and provide quick support. |

| Focus | HR team is bogged down in administrative tasks and paperwork. | HR team is free to focus on strategic initiatives like talent and culture. |

As you can see, outsourcing offers a significant shift in how resources are allocated, turning a reactive administrative function into a proactive, strategic advantage.

Let’s be honest: benefits administration is a regulatory minefield. One wrong move with the ACA, COBRA, or ERISA can result in crippling financial penalties and legal nightmares. Specialized providers live and breathe these rules. Their entire business is built on staying ahead of legislative changes—a full-time job your HR generalist simply doesn't have the bandwidth for.

By partnering with an expert, you’re not just buying a service—you're purchasing peace of mind. You gain a compliance shield, seriously reducing your company's risk while making sure your benefits are always up to code.

Rising costs and increasing complexity have made employee benefits a top-tier challenge. A recent survey underscored this, showing that over two-thirds of employers point to cost pressures as a major driver in their benefits strategy. Instead of cutting back, they're turning to external administrators who can negotiate better deals and implement more efficient models.

Beyond the direct cost savings, a huge driver for outsourcing is the chance for Mastering Financial Workflow Automation, which lets your internal teams get back to high-impact work. Imagine an open enrollment season without the usual chaos of lost paperwork, frantic emails, and the same five questions asked a hundred times. An outsourced partner brings a streamlined, often self-service, platform that helps employees make smart decisions about their own coverage.

This better experience has a direct and positive impact on morale and retention. When your team has easy access to information and quick, expert support for their benefits questions, they feel more valued. This approach also fits perfectly with modern workforce expectations, especially if you're building a distributed team. As you look at global talent pools, you may find that outsourcing aligns well with other strategic moves, like how hiring remote workers from Latin America can boost efficiency and talent acquisition.

So, you're thinking about outsourcing your employee benefits. It’s a big decision, and the first step isn't browsing vendors—it's taking a hard, honest look at what you're doing right now. You need to get into the weeds of your current process.

Before you can even think about what a partner could do for you, you have to know your numbers. Document every single task, from the chaos of open enrollment to the painstaking details of compliance reporting. For example, open enrollment might chew up 30 hours of HR time every year. That’s a known headache. But what about the hidden time sinks? Tracking ACA filings could easily consume another 15 hours through a tangled mess of spreadsheets and follow-up calls.

These hours add up, and quantifying them is the only way to see where a benefits partner could deliver the biggest relief.

Get specific with your audit. Don't just guess—start tracking.

Once you have a feel for the tasks, physically draw out your benefits process. Create a workflow diagram that follows an employee's journey from their first day—enrolling in benefits—to making a life-event change.

This visual map is incredibly revealing. You’ll almost certainly spot redundant approval steps or clunky manual handoffs that create frustrating delays. It's common to find at least two or three bottlenecks that a good outsourcing partner could automate away instantly.

A clear process map can cut enrollment time by 25% when automated.

With your pain points identified, you can now set clear, measurable targets for what you want to achieve by outsourcing. Vague goals like "save time" won't cut it. You need concrete metrics.

Think in terms of:

These numbers aren't just for you; they become the checklist you use when vetting potential vendors. You can directly compare their service guarantees against your specific goals.

For instance, one 100-employee company we worked with did this exact exercise. They discovered their quarterly enrollment workload was a staggering 120 hours. After outsourcing, it dropped to just 40 hours. Even better, support tickets from confused employees during open enrollment plummeted by 60%. That’s the kind of real-world impact you can expect when your goals align with your vendor's capabilities.

Now you're ready to talk to vendors. Armed with your logged hours, process maps, and defined goals, you can evaluate their proposals objectively instead of just comparing prices.

Look for a partner whose SLAs directly address your targets for task reduction and support response times. Critically, you need to verify that their platform integrates smoothly with your existing HRIS—no one wants to be stuck with manual data exports.

As you vet potential partners, make sure you:

When the numbers, your process needs, and a vendor’s solution all click into place, the decision to outsource becomes a confident, strategic move. Your internal audit does more than justify the cost; it gives you a clear roadmap to ensure the partner you choose will solve your real problems and deliver results you can measure.

Picking a partner to handle your employee benefits administration is a massive decision. A slick sales pitch just won't cut it. You're looking for a true partner, not just a software vendor, and that means finding a provider whose technology, security, and service philosophy are a perfect match for your company. This is where a battle-tested vetting process becomes your best friend.

It's a decision more and more companies are making. The human resources outsourcing market, which covers benefits administration, is booming—it's projected to hit $276.44 billion by 2025 and keep growing by about 5.48% each year through 2033. This isn't just a trend; it's a sign that smart organizations are handing this critical function over to experts to boost efficiency and service. You can explore the full HR outsourcing research to see just how big this shift is.

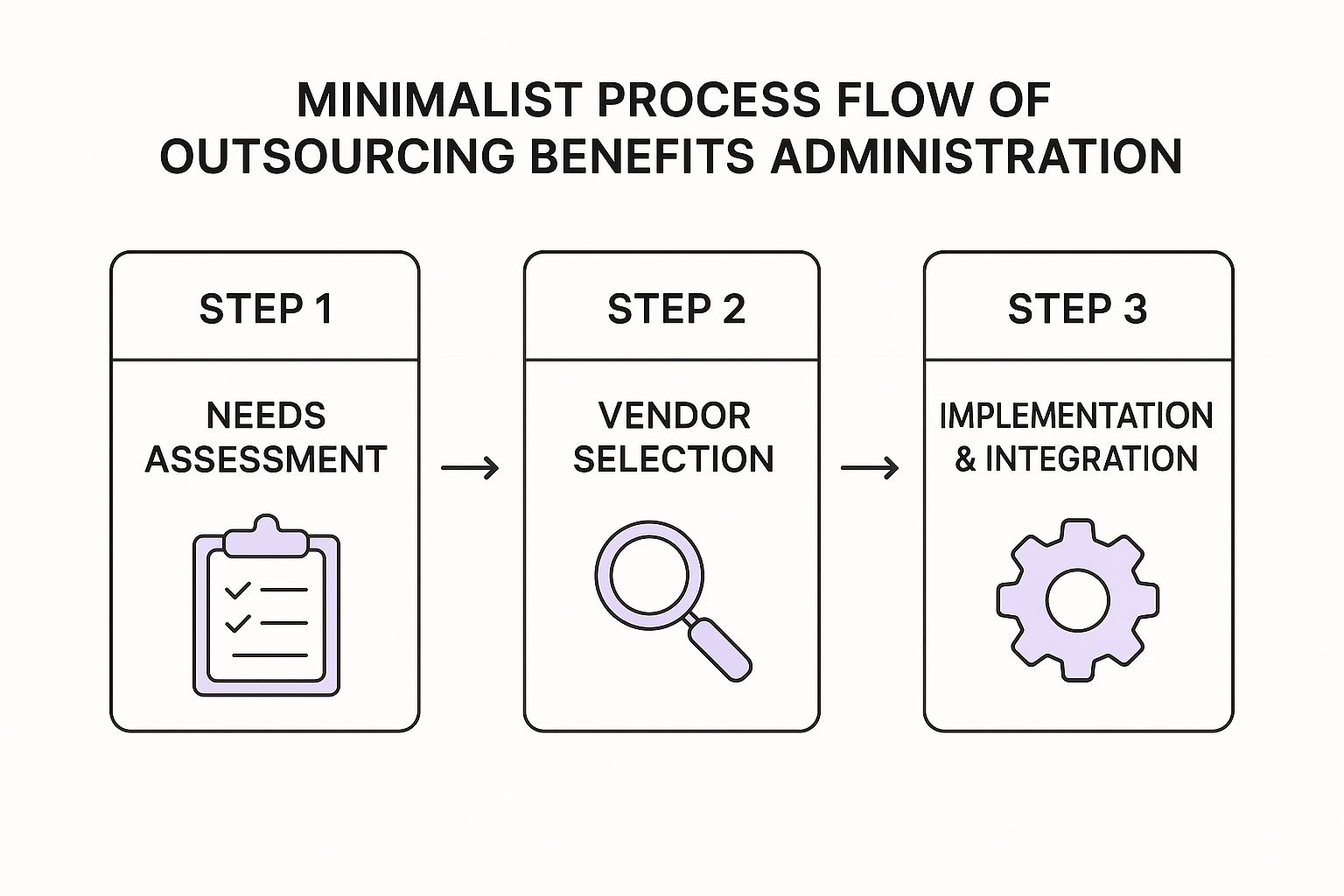

To get this right, you need a clear plan. The infographic below breaks down the core stages, from the initial soul-searching to the final go-live.

As you can see, the real work starts long before you ever sign a contract. It begins with a deep dive into your own needs and a meticulous vendor hunt.

First things first: the tech. A clunky, hard-to-use platform will create more headaches than it solves. More importantly, it absolutely must play nice with your existing Human Resources Information System (HRIS) and payroll software. Bad integrations are a nightmare.

Get right to the point and ask direct questions about their integration process:

Compliance is completely non-negotiable. Your potential partner needs an ironclad track record with the alphabet soup of regulations—ACA, COBRA, ERISA, and more.

A provider's apathetic approach to compliance becomes your direct liability. Don't just take their word for it—demand proof of their processes and historical performance.

Data security is just as critical. You’re handing over incredibly sensitive employee information, so a robust security protocol isn't a "nice-to-have." It's a fundamental requirement.

Probe their expertise with some pointed questions:

For instance, picture this scenario: an employee needs to add their newborn to the health plan outside of open enrollment. A great partner can explain exactly how their system flags the qualifying life event, notifies the carrier, and confirms the payroll deduction change, all while keeping the employee in the loop. That level of detail is what separates a true partner from a simple software vendor—and ensures they’ll be there for your team when it really matters.

You’ve vetted the vendors and signed the contract—congratulations. Now, the real work begins. I've seen great partnerships for outsourcing employee benefits administration sour because of a clumsy, poorly planned implementation. This is where a provider truly proves their worth, moving from promises on paper to actual performance.

A successful rollout all comes down to meticulous planning, crystal-clear communication, and a shared understanding of who is doing what.

First things first, you need a detailed project timeline, hammered out with your new partner. This isn't just a list of dates; it's your collaborative roadmap. For a mid-sized company, a full implementation—from data migration to getting employees trained—realistically takes 60 to 90 days. Rushing this is a recipe for disaster. It leads to errors that can disrupt coverage and create massive headaches for your team.

A critical piece of this timeline is defining roles using a RACI (Responsible, Accountable, Consulted, Informed) chart. Get specific. Who is responsible for providing the initial employee census data? Who gives the final sign-off on system configurations? Spell it all out.

The backbone of any smooth transition is accurate data. Period. Your new provider will need a clean, comprehensive data file with all the necessary employee and dependent information. Any inaccuracies here will snowball into problems with enrollment, carrier feeds, and payroll deductions. It gets messy, fast.

Here’s a pro tip: run parallel systems for at least one pay cycle. This means you run your old benefits process alongside the new outsourced system. Yes, it’s extra effort, but it's the single best way to catch discrepancies before they affect your employees. You can compare payroll deduction reports from both systems side-by-side to ensure every single dollar is correct.

A parallel run is your ultimate safety net. It validates data accuracy and confirms that all integrations with payroll and your HRIS are functioning exactly as expected. It’s your best shot at ensuring zero disruption on day one.

This phase is also when you'll be deep in the weeds configuring the new platform to match your specific plan rules and eligibility requirements. It’s a detailed process that demands your team's input and, ultimately, your final sign-off.

How you communicate this change to your employees is just as important as the technical setup. If your team feels anxious or in the dark, they're more likely to resist the change and flood your HR department with questions. The goal here is to be proactive, transparent, and reassuring.

A solid communication plan should look something like this:

This whole process shares a lot of principles with introducing any new system or even a new team member. For remote teams, these communication strategies are even more critical. To learn more, check out our in-depth guide to the remote onboarding process, which is packed with valuable tips on clear communication and setting expectations.

By managing the implementation with care, you're not just launching a new system—you're setting the stage for a successful long-term partnership.

Once you’re live, the real work begins. Your role in outsourcing employee benefits administration just made a major shift. You're no longer buried in the day-to-day grind; you're now the manager of a strategic relationship, responsible for making sure you squeeze every ounce of value from your investment. This is how you turn a provider from a simple vendor into a genuine partner.

This move from doer to manager is becoming the new normal. In fact, over 50% of companies worldwide now outsource some part of their benefits administration. They’re driven by ever-changing regulations and the need for employee-facing tech that doesn't feel like it’s from 1999. This lets internal teams get back to focusing on what they do best. If you're curious, you can read more about these outsourcing trends to see why so many are making this leap.

Your main job isn't processing forms anymore. It's about maintaining strong oversight and steering the ship. The best way I’ve seen this done is by setting up a regular, structured rhythm for communication with your provider. Don’t just wait for something to break.

A great place to start is with quarterly business reviews (QBRs). These meetings are your chance to get out of the weeds and focus on the big picture.

During your QBRs, you should be hitting these key topics:

Think of your provider as an extension of your own team. Their expertise is now your expertise. Use their deep knowledge of compliance and market trends to stay ahead of the curve, not just react to it.

This kind of proactive management ensures the partnership stays aligned with your goals and keeps delivering value long after the confetti from the launch party has been swept up.

Let's be honest, a huge reason you outsourced was to get access to better tech. Now’s the time to push it hard. Your provider’s platform—especially its self-service portal and mobile app—is your number one tool for making your employees' lives easier.

Actively encourage your team to use these resources. For instance, when an employee comes to you to update their address, don't just do it for them. Walk them through how to do it in two clicks on the portal. It saves everyone time and, more importantly, empowers employees to take ownership of their own benefits. A well-used portal can slash the administrative load on your team.

Finally, let's talk about the most powerful part of this new partnership: data. Your provider’s platform should have robust reporting and analytics that offer incredible insights into your benefits program. Get in there and get your hands dirty.

Dig into the reports to understand things like:

This data is gold. It lets you move away from making decisions based on gut feelings. Instead, you can use hard evidence to design a benefits package that’s both cost-effective for the company and truly valued by your employees.

Making the switch to outsourcing benefits administration is a big move, and it's completely normal for questions to start bubbling up. Before you commit, you need clear, straightforward answers. Let's tackle some of the most common concerns we hear from business leaders who are on the fence.

One of the first questions is almost always about control. The fear is that you'll lose oversight of a critical part of your business. But a good partnership isn't about giving up control—it's about shifting your focus. Instead of getting bogged down in paperwork and day-to-day admin, you get to manage the relationship and the high-level strategy. You still call the shots on benefit offerings and make the final decisions; you just delegate the time-consuming execution to the experts.

Another huge point of discussion is the employee experience. Will your team feel disconnected or left in the dark by a third party? It’s a valid concern, and the answer really hinges on the partner you choose. A top-tier provider becomes a seamless extension of your HR team. They provide intuitive self-service portals and expert support that can often be even better and more responsive than what a swamped in-house team can deliver.

This is the million-dollar question for a lot of companies. While there’s an upfront fee for any provider, the long-term savings are often substantial. To see the full picture, you have to look beyond the invoice and consider the hidden costs you’re already paying.

These "soft costs" add up fast:

When you factor in the reduced risk and the boost in operational efficiency, the return on investment becomes much clearer. It’s not just about writing a check; it's about making a smarter financial and operational decision for the company.

Managing benefits across different countries throws a whole new layer of complexity into the mix, which is where outsourcing becomes incredibly valuable. A provider with global reach is built to navigate the maze of unique regulations, currency conversions, and cultural expectations in each country.

This ensures all your employees, no matter where they are, receive fair, competitive, and fully compliant benefits. For a deeper dive into this, our guide on international benefits administration breaks down exactly how to manage a distributed workforce.

Take this real-world scenario: a U.S. company hiring in Brazil suddenly has to deal with mandatory benefits like the FGTS (an unemployment guarantee fund) and transportation vouchers. A specialized global provider handles this seamlessly. You stay compliant without ever needing to become an expert in Brazilian labor law. That kind of specialized support is one of the biggest wins when outsourcing for a global team.