Ever tried to plug your phone charger into a foreign outlet without an adapter? It’s a simple problem, but it stops you cold. Global payroll services are that universal adapter for your company, but instead of fitting power sockets, they navigate the wildly different rules for pay, taxes, and labor laws in every country you operate in.

The goal is simple: make sure your international team gets paid correctly and on time. Every single time.

On the surface, global payroll services look like specialized cross-border payment solutions. But they go so much deeper. It’s not just about sending money across borders; it's a complete system built to manage compliance, untangle complex tax codes, handle currency conversions, and bring order to an otherwise fragmented process.

Imagine trying to manage payroll in ten different countries. That means ten different local providers, ten separate logins, and ten unique, often confusing, processes. A global payroll service gets rid of that chaos. It consolidates everything into one central hub, giving you a single, clear view of your entire international payroll operation.

A truly effective global payroll solution has to juggle several critical tasks that would be a nightmare for an in-house team to handle alone. These functions all work together, creating a seamless experience for both the company and its employees.

Here’s what they typically cover:

The market for these services is blowing up as more companies go global. The payroll services market was recently valued at around USD 71.14 billion and is expected to climb to USD 73.37 billion. This growth isn't surprising when you consider how complex payroll regulations have become and how many businesses now operate internationally.

Thinking of global payroll as just another administrative task is a major missed opportunity. When you get it right, it becomes a strategic advantage. It powers your international growth, builds trust with your employees, and shields your business from massive financial and legal headaches.

When you are trusted with someone’s payroll, you are trusted in a very dramatic sense, with their life. Confidence in payroll systems is built through availability, accuracy, and strict compliance.

This really gets to the heart of it. Payroll is personal. A reliable, accurate process is the bedrock of a good employee experience. It’s a clear signal that you value your international team, which builds the kind of loyalty and stability you need to succeed on a global scale.

Moving from a patchwork of local payroll vendors to a single, centralized system is more than just an administrative shuffle—it’s a fundamental upgrade to your global operating model. Think about the old way: juggling dozens of local contacts, trying to make sense of conflicting advice, and manually stitching together reports. It's messy and inefficient.

A centralized approach creates one source of truth for your entire international workforce. This shift turns a chaotic, resource-draining task into a powerful strategic asset. When your global payroll services are unified, you gain the clarity, control, and consistency needed for sustainable growth. It’s the difference between trying to conduct an orchestra with ten different conductors and having one expert lead a flawless performance.

One of the first things you'll notice after centralizing is a dramatic drop in errors. When each country’s payroll operates in its own silo, compliance gaps and inconsistencies aren't just possible; they're practically guaranteed. A small miscalculation in Germany, a misunderstanding of Brazil's dense labor laws, or a missed tax deadline in the UK can quickly spiral into major fines and legal headaches.

Centralizing through a single platform brings in standardized validation checks and automated compliance updates. This system acts as a built-in safety net, catching potential issues before they become expensive problems. For example, the platform can automatically flag incorrect tax withholdings or ensure statutory requirements like 13th-month pay are applied correctly, shielding your business from unnecessary risk.

Centralizing payroll transforms it from a reactive, fragmented cost center into a proactive, unified asset that fuels global growth, enhances employee trust, and provides invaluable strategic insight.

This is the core idea. Instead of just being an expense line, a well-run, centralized payroll becomes a tool for smarter decisions and a stronger global footprint.

Your HR and finance teams should be strategic partners, but they can't focus on high-value work if they're drowning in payroll admin. Chasing down data across different time zones, managing a roster of local vendors, and manually consolidating reports is an incredible time-sink. It’s inefficient and, frankly, a waste of their talent.

A unified global payroll services solution automates these mind-numbing tasks. By taking over data collection, processing, and compliance checks, the system liberates your internal teams to focus on what actually drives the business forward:

This operational freedom is a huge advantage for scaling. As you expand into new markets, you won’t have to start from scratch finding and vetting a new local payroll vendor every single time. Your centralized system is built to grow with you, making international expansion far smoother and more predictable.

Finally, let’s not forget the people. A centralized system has a profound impact on the employee experience. Nothing kills trust faster than getting paid incorrectly or late. When employees in different countries have wildly different experiences—some paid on time, others facing delays; some getting clear pay stubs, others getting confusing ones—it creates a sense of inequality and instability.

A single platform ensures every employee, no matter where they are, gets the same high-quality service. They get paid accurately and on time, every time. Many of these platforms also come with employee self-service portals, giving your team secure, easy access to their pay stubs and tax documents. This level of transparency and reliability builds trust and shows your global team they’re valued, which is absolutely critical for long-term loyalty and retention.

Trying to understand how global payroll services work can feel like tracking a single package sent through a dozen different couriers at once. It seems chaotic, but the process is actually designed to be incredibly logical and secure. It takes a jumble of international data and transforms it into a reliable, streamlined payment system for your entire team.

Let's demystify this workflow by following your payroll data on its journey. Say you have employees in the Philippines, the UK, and Brazil. Each person generates unique data points—hours worked, overtime, local tax details, and social security contributions. A centralized global payroll platform acts as the single, secure hub where all this disconnected information is sent.

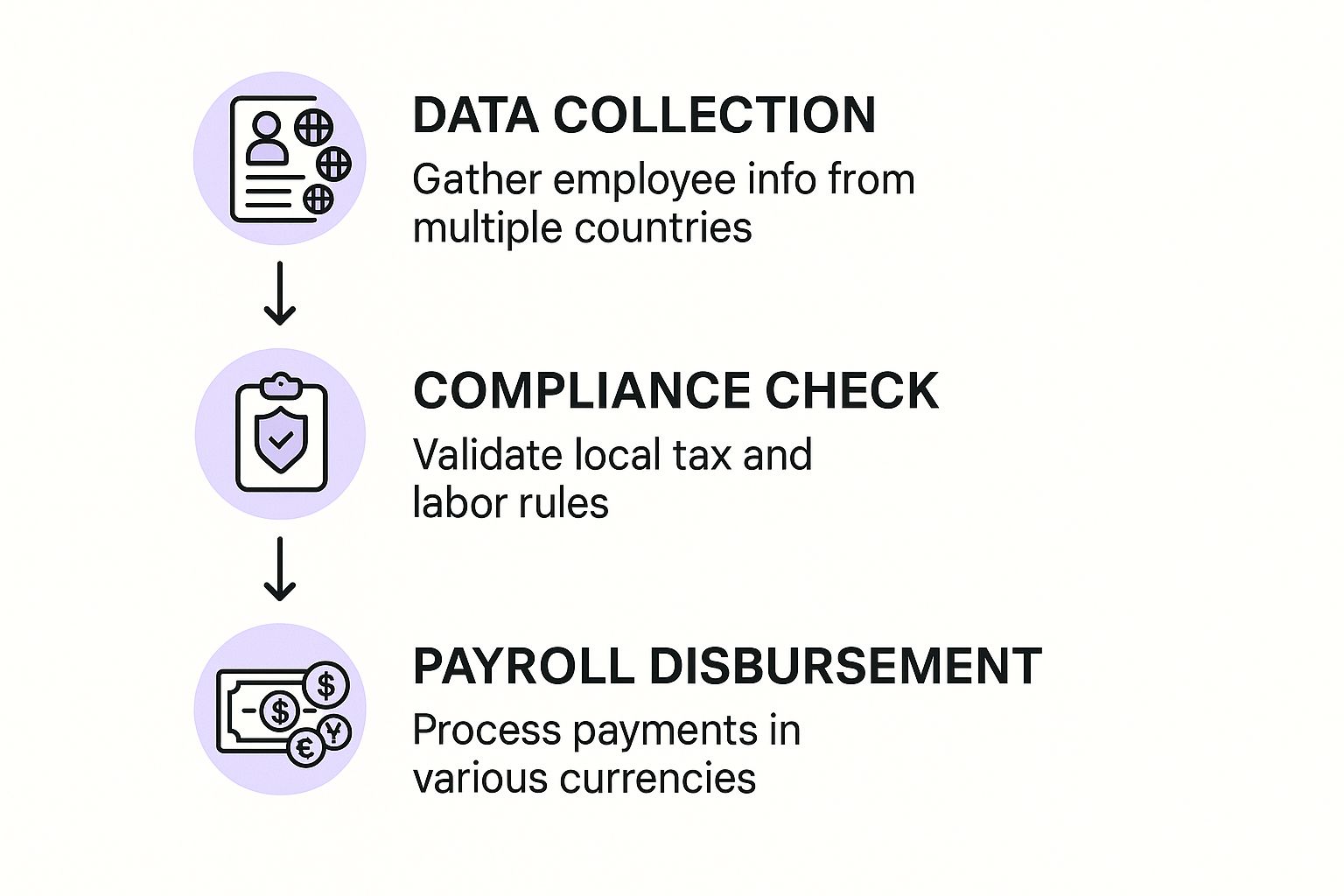

This infographic breaks down the core three-step journey, from initial data collection to the final payment hitting your employees' bank accounts.

As you can see, a unified system is what turns messy, multi-country inputs into a compliant, executable process. This centralized flow is the secret to stamping out errors and finally gaining real operational control.

Everything kicks off with gathering all the necessary payroll information. This goes way beyond simple salary figures. It includes a whole host of variable data that changes with every single pay cycle.

Once everything is collected, the global payroll platform gets to work standardizing it. Information from your Brazilian team, recorded in Brazilian Reais, is harmonized right alongside data from your UK team in British Pounds. This creates a single, unified dataset, which makes cross-country comparisons and validation not just possible, but easy. Without this step, you’d be stuck manually reconciling reports in different formats and languages—a perfect recipe for costly mistakes.

This is where the true power of global payroll services really shines. With all the data consolidated, the platform runs a battery of automated validation and compliance checks. Think of it like having an expert local accountant for every single country, built right into your workflow.

The constant struggle for global organizations is "keeping up with all the ever-changing regulations." A rock-solid validation process is your first and best line of defense against non-compliance.

These checks are designed to spot errors before they snowball into real problems. For example, the system might flag an unusually high overtime payment for an employee in the Philippines, prompting a quick manual review. Or, it could automatically confirm that the tax withholdings for your UK employee are perfectly aligned with the latest HMRC updates. It’s a proactive approach that ensures accuracy and locks in adherence to local laws, protecting your business from fines and legal headaches.

After the payroll data is double-checked, validated, and approved, we get to the final step: funding and paying your people. The provider calculates the total amount needed to cover everything—salaries, taxes, and other contributions—across all currencies. You just fund a single account, and the provider takes it from there.

They handle all the currency conversions and execute the final payments to each employee in their local currency. This means your team in Brazil gets their salary in Brazilian Reais, and your team in the UK gets theirs in British Pounds, all on the right payday. It’s this final, seamless step that guarantees your international team is paid accurately and on time, building the trust that’s absolutely essential for a strong global workforce.

Not long ago, global payroll was a slow, painfully manual affair. It was an administrative burden, plain and simple. Those days are gone. Technology has completely flipped the script, turning what used to be a headache into a real operational advantage. Modern global payroll services now run on smart automation, AI, and cloud platforms that do much more than just cut checks.

This isn't just a minor upgrade; it's a total reimagining of what payroll can be. Instead of just following instructions, today’s systems are built to spot risks, clean up data flows, and give both companies and their people more control than ever before.

Artificial intelligence is at the heart of this transformation. AI-driven platforms can sift through enormous amounts of data, catching patterns and red flags a human might easily miss.

Imagine the system automatically flagging a potential compliance issue in a new hire’s contract in France. It alerts HR to a possible legal misstep before it becomes a problem. This kind of proactive risk management is a true game-changer.

These smart systems also automate data validation. Forget manually cross-checking spreadsheets. The platform can instantly verify new payroll data against historical records and country-specific rules, dramatically cutting down on human error. This frees up payroll professionals to focus on big-picture strategy instead of tedious data entry. This shift is a major force behind the industry's growth; the global payroll market, valued at around USD 98.5 billion, is expected to hit nearly USD 133.69 billion by 2028.

A modern payroll platform isn't just a calculator; it's a co-pilot. It uses technology to automate routine tasks, identify potential compliance risks, and provide the real-time data needed for smart, strategic decision-making.

Ultimately, this approach doesn't just guarantee accuracy—it transforms payroll into a source of powerful business intelligence.

Cloud technology is the engine that powers modern global payroll. By bringing all payroll data together on a single, secure cloud platform, companies finally get a unified view of their entire global workforce. No more juggling dozens of spreadsheets or logging into separate portals for each country.

This "single source of truth" delivers some huge wins:

Another huge leap forward is the employee self-service (ESS) portal. These secure, easy-to-use portals give employees direct access to their own payroll information. It’s a better experience for them and a massive time-saver for HR.

Through an ESS portal, an employee can typically:

This autonomy boosts employee satisfaction and slashes the number of routine questions your HR team has to field. For companies with distributed teams, this is a must-have. Giving employees control over their own data is a critical piece of the puzzle when you're figuring out how to manage remote teams effectively.

Much of this automation is powered by technologies that extract and organize data automatically. To get a better sense of the mechanics, you can learn more about how OCR is used for image to spreadsheet conversions, a similar principle that helps streamline data-heavy processes like payroll.

When you’re expanding your business across borders, payroll compliance quickly becomes your single biggest headache. It’s not just about paying people; it's a tangled web of rules that shift constantly and look wildly different from one country to the next.

Getting it wrong is far more than a simple administrative slip-up. It can lead to staggering fines, legal battles, and a reputation that’s tarnished before you’ve even found your footing in a new market. This is exactly where expert global payroll services step in, acting as an essential shield for your company. They’re built to manage these risks, turning a massive liability into a predictable, well-oiled process.

The pitfalls in global payroll are everywhere, but a few common traps catch even savvy businesses off guard. These issues usually pop up when companies assume what works in their home country will work just fine somewhere else—a dangerously flawed assumption.

Here are a few real-world compliance nightmares you want to avoid:

A top-tier global payroll service has local experts who live and breathe these rules. They make sure every deduction is precise and every mandatory payment is handled, steering you clear of these costly mistakes.

Think of a global payroll service as your compliance co-pilot. It’s a smart combination of on-the-ground human expertise and technology that keeps your operations safe and squarely on the right side of the law. This proactive stance is what separates a true partner from a simple payment processor.

When you are trusted with someone’s payroll, you are trusted in a very dramatic sense, with their life. Confidence in payroll systems is built through availability, accuracy, and strict compliance.

This expert insight cuts to the core of the issue. Compliance isn't just about dodging fines; it’s about building unshakable trust with your global team. Your employees need absolute confidence that they’re being paid correctly and in full accordance with their local laws. This trust is the bedrock of a happy, productive, and loyal workforce.

A key function of these services is to proactively manage all the local and regional requirements that go far beyond just taxes. For instance, benefits are a whole other can of worms to manage across borders. For a deeper dive, our guide on international benefits administration sheds more light on this related challenge.

A robust global payroll partner will take care of:

By handing over these complex and high-stakes tasks to a specialized provider, your business is free to expand with confidence. You get to focus on strategy and growth, knowing the critical, risk-filled parts of payroll are being expertly managed in every country you operate in.

Picking a partner for your global payroll services is a massive business decision—right up there with choosing a financial partner or a key investor. This isn't just about offloading an administrative headache; it's about handing over a critical piece of your employee relationships and international compliance to someone else.

The right partner melts into the background, becoming a seamless extension of your own team. The wrong one? They can unleash a storm of chaos, risk, and frustration that ripples through your entire organization. You have to look past the slick sales pitches and dig deep to see if a provider can actually handle your company’s real-world needs. Can they deliver accurate, compliant payroll every single time? And can they scale with you as you grow?

Before you even think about signing a contract, it's time for some serious due diligence. A quick glance at a provider's website just won't cut it. You need a structured way to evaluate each potential partner, holding them all to the same high standard. This is how you compare apples to apples and make a decision based on substance, not just clever marketing.

Here are the non-negotiable areas to investigate:

This is a space that's growing incredibly fast. The global payroll services market is expected to rocket from around $6.78 billion to nearly $13.13 billion by 2033, largely thanks to the shift to cloud-based tech. You can read more about these market growth projections and trends to get a feel for the landscape. More options are great, but it also makes a thorough evaluation more critical than ever.

Once you've narrowed it down to a shortlist, it's time to get specific. The answers to these questions will tell you everything you need to know about a provider's operational maturity and how much they actually care about their customers.

A partner’s value is measured not just by the technology they offer, but by the expertise and support that stand behind it. Localized teams who speak the language and know the rules are a non-negotiable asset.

This emphasis on local expertise is absolutely vital, especially when you're breaking into new regions. For example, scaling your operations successfully depends on a deep understanding of the local business culture and talent pool. For those looking at this dynamic region, you might find it useful to read about why hiring remote workers from LatAm is a smart business move.

By arming yourself with this checklist and asking these tough questions, you can cut through the noise. You’ll be able to spot a true global payroll services partner—one who can support your international ambitions and become a trusted advisor on your journey.

As you start exploring the world of global payroll services, you're bound to have some practical questions. This isn't just about high-level strategy; it's about the nuts and bolts of making a new system work for your business. We've gathered the most common questions we hear to give you clear, straightforward answers.

This is a frequent point of confusion, but getting it right is critical. The best way to think about it is like renting a car versus hiring a full-service chauffeur.

A global payroll provider is like renting the car. It processes payroll for your employees who work for your existing legal entities in other countries. You've already set up shop there, and you're simply hiring a specialist to handle the complex mechanics of paying your team according to local rules.

An Employer of Record (EOR), on the other hand, is the full-service chauffeur. They become the legal employer for your staff in a country where you do not have your own entity. They handle it all—payroll, benefits, taxes, and local compliance—on your behalf. You direct the employee's day-to-day work, but the EOR manages their official employment from A to Z.

Key Takeaway: A payroll provider pays your team through your company. An EOR legally hires and pays your team on your behalf, so you don't have to set up a local entity.

There’s no single magic number here. Implementation timelines can vary quite a bit based on a few key factors: the number of countries you’re expanding into, the complexity of your payroll, and how clean your internal data is.

A simple, single-country rollout for a small team might be wrapped up in just a few weeks. But for a large-scale, multi-country implementation with complex compensation structures, you should realistically plan for anywhere from three to six months. A good partner will be transparent from day one, giving you a clear, phased timeline so you always know what’s happening next.

You should demand nothing less than ironclad, enterprise-grade security. After all, you’re entrusting a partner with your company's most sensitive financial data and your employees' personal information. There's no room for compromise.

Here are the non-negotiables: