A payroll outsource company is a third-party firm that manages every piece of your business's employee compensation. Think calculating wages, handling tax withholdings, and making sure you’re compliant with all the fun labor laws. For most founders, it's the off-ramp from becoming an accidental payroll clerk—a way to get back the countless hours lost to administrative hell.

It always starts small, right? A quick tax form here, a direct deposit correction there. You tell yourself it’s just part of the startup grind.

Then, one Tuesday afternoon, you find yourself three browser tabs deep in a state labor law manual, trying to figure out overtime rules for a remote employee in a different time zone. Suddenly, you’re spending more time decoding compliance nightmares than you are building your actual product. This isn't what you signed up for.

This is the moment every founder dreads—the realization that you’re now the head of an understaffed, under-qualified, and highly stressed HR department of one.

Let’s be honest: of all the hats a founder wears, the payroll administrator hat is the absolute ugliest. It’s itchy, ill-fitting, and comes with a serious risk of expensive, soul-crushing audits from government agencies that don't care about your "move fast and break things" philosophy.

The pain points are real, and they multiply with every single new hire:

This isn't just about saving time; it's about reclaiming your focus. Outsourcing payroll isn't giving up control. It’s taking back control of your most valuable assets—your time, your sanity, and your ability to build the business you actually set out to create.

Shifting to a payroll outsource company is becoming less of a choice and more of a strategic necessity for any business that wants to grow. The market is set to expand by $6.15 billion as more founders realize the stakes are just too high.

And they are high. With 49% of employees reportedly ready to leave a job after just two paycheck errors, accuracy is completely non-negotiable. If you want to dig deeper, you can learn more about the latest payroll outsourcing statistics and trends to see why so many are making the switch.

Choosing a payroll partner is one of the first, best decisions you can make to get out of the administrative weeds and get back to work that matters.

Let's get straight to the number that really matters: money.

Every payroll company's sales pitch is designed to look simple and appealing. You see a slick website advertising a low per-employee-per-month (PEPM) fee and think, "Wow, that's a steal!"

Spoiler alert: it's almost certainly not. That shiny, low number is often a Trojan horse, hiding a whole army of fees ready to storm your budget the moment you sign the contract. I’ve learned this the hard way more than once.

Think of that base fee as just the cover charge to get in the door. The real costs are tucked away in the fine print, waiting to pop up when you can least afford them.

The sales team will happily walk you through all the flashy features, but they tend to get quiet when you start asking about the "extras." And make no mistake, these aren't rare edge cases; for most businesses, they're guaranteed costs. Your job is to drag every single one of them into the light before you commit.

Here are the usual suspects I’ve learned to hunt for on every sales call:

A payroll provider’s pricing model tells you everything about their philosophy. If it’s confusing and riddled with add-ons, they see you as a transaction. If it's transparent and all-inclusive, they see you as a partner.

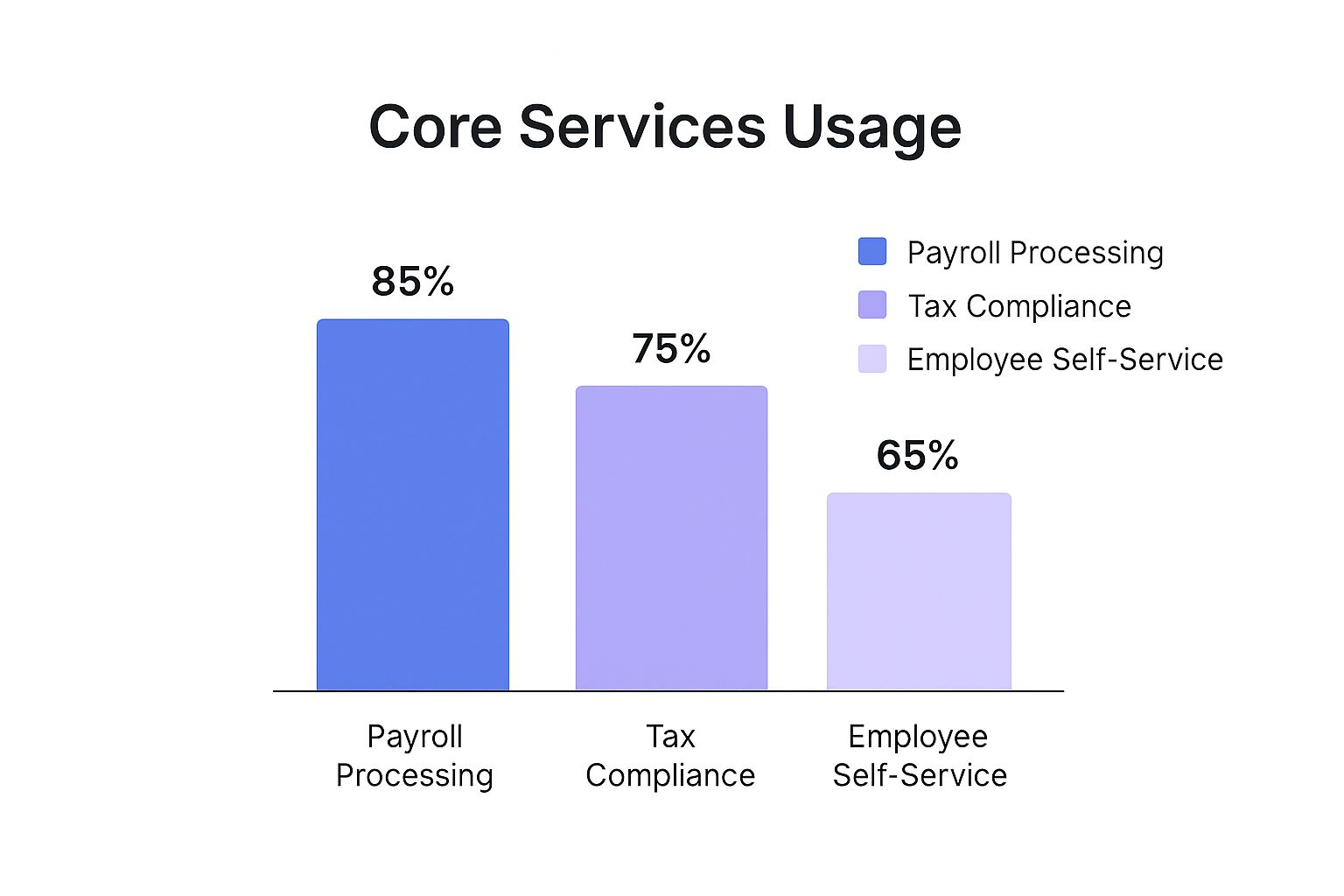

This bar chart gives a great visual of the core services that businesses actually rely on when they partner with a payroll outsource company.

As the data shows, while basic payroll is the main driver, things like tax compliance and employee self-service are nearly just as critical. You need to make sure these aren't being sold to you as expensive "add-ons."

That slick marketing PDF isn't your friend. You need to build your own cost model. To do this, you have to grill the sales reps on every possible scenario. I use the table below as my personal checklist during sales calls to translate their pitch into reality.

| Fee Type | What They Tell You (The Pitch) | What It Often Means (The Reality) |

|---|---|---|

| Base Fee | "It's just $12 per employee per month!" | This likely covers only the most basic direct deposit service. |

| Setup Fee | "A one-time fee to get you started." | Can range from a few hundred to several thousand dollars. |

| Off-Cycle Payroll | "We offer flexible payroll runs." | Each extra run costs $50–$150, penalizing you for bonuses. |

| Tax Filing | "We handle all your tax obligations." | State and local filings might be included, but year-end forms are extra. |

| Amendments | "Our platform is easy to use." | Correcting an error (yours or theirs) can cost $100+ per instance. |

| Customer Support | "24/7 support is available." | This usually means a chatbot. Access to a real expert costs more. |

| Termination Fee | Silence | If you want to leave, you might owe them a hefty fee for the remainder of your contract. |

This isn't about being cynical; it's about being prepared. A trustworthy partner will give you straight answers to these questions. A shady one will dodge, deflect, and try to keep the conversation focused on the low base price.

Start with their advertised PEPM fee, and then build from there. To make sure you're covering all your bases, you can reference a solid payroll compliance checklist to anticipate regulatory steps that might trigger surprise fees.

Don't be afraid to be direct. Ask them point-blank: "Give me a line-item quote for one full year, assuming 15 employees, two off-cycle runs, one corrected tax filing, and all year-end processing."

If they can't or won't provide that, it’s a massive red flag.

For businesses with teams spread across multiple countries, this complexity multiplies tenfold. To get a better handle on the nuances of managing payroll across borders, it's worth exploring a comprehensive global payroll guide.

At the end of the day, you’re not just buying a piece of software; you're entrusting a critical business function to a partner. Do your homework, compare the real numbers, and ignore the sales gimmicks.

A slick demo can hide a world of pain. I've seen platforms that look amazing on a webinar but are a complete nightmare in practice. This is where we move past the sales pitch and get into the gritty, essential details of a proper vetting process.

Choosing a payroll outsource company isn't like buying software; it's like hiring a critical team member you’ll hopefully never have to see. You need to trust them implicitly, because when they mess up, it's your reputation on the line with your team.

The first thing to dissect is their actual tech stack. Sales reps love to show off a clean user interface, but the real magic—or misery—happens in the backend integrations.

Ask them to show you, not just tell you, how their system connects with your accounting software. Is it a true, API-driven integration that syncs automatically, or are you going to be stuck in a CSV import-export purgatory every two weeks? I’ve been there. It’s not pretty.

Technology is only half the battle. The other half is the human support system behind it. When a tax agency sends a scary-looking letter or an employee’s direct deposit goes missing, who are you actually talking to?

Is it a dedicated account manager who knows your business, or a generic ticket system that sends an automated reply promising a response within 48 hours?

Your payroll provider's support model is a direct reflection of their priorities. A faceless ticketing system means they prioritize their own efficiency over your emergencies. A dedicated rep means they see you as a partner.

This isn't just a preference; it’s a core operational need. The global HR outsourcing market is projected to blow past $400 billion by 2032, largely because the ROI is so high—averaging 191%. That return doesn't come from fancy software alone; it comes from having experts who prevent costly mistakes and save you time. This is a clear indicator of how critical that support function truly is.

Don't get swayed by a smooth talker. Go into every conversation with a checklist. Here’s a simplified version of the one I use to keep myself grounded:

| Criteria | Green Flag (Keep Talking) | Red Flag (Run Away) |

|---|---|---|

| Support Model | You get a dedicated, named representative. | You're funneled into a generic support queue or ticket system. |

| Tech Integration | They offer live demos of their API connecting to your specific software. | They say "we can export a CSV" for everything. |

| Compliance Record | They can provide references and case studies of clients in complex states. | They get vague when you ask about multi-state or international tax filings. |

| Security Protocols | They proudly display their SOC 2 or other security certifications. | They can't give a straight answer on data encryption or compliance. |

This process is especially crucial if you're looking beyond domestic hiring. If you're building a distributed team, our guide on how to hire international employees offers a deeper look into the complexities you'll need your partner to handle.

Choosing the right payroll outsource company is a big decision. Take your time, ask the hard questions, and trust your gut. A little extra due diligence now will save you a world of headaches later.

The deal is signed. The sales team, who were your best friends for the last three weeks, have vanished. You’ve just been handed off to an “onboarding specialist” you’ve never met. Welcome to the messy middle.

This is the moment of truth. A slick demo is one thing, but a smooth implementation is the single biggest predictor of a happy, long-term relationship with your payroll outsource company. What happens in the next 30 to 60 days will set the tone for everything. This isn’t the time to sit back and hope for the best; it’s time to get hands-on.

Let’s be brutally honest: a bad onboarding experience is a nightmare. It’s a chaotic scramble of missed deadlines, confusing data requests, and that sinking feeling you’ve made a terrible mistake. A good onboarding process, on the other hand, feels like a well-oiled machine. It’s structured, transparent, and led by someone who inspires confidence, not panic.

You absolutely need to assign a dedicated project manager on your side—even if it's you. Someone has to own this process, hold the provider accountable for their timeline, and be the single point of contact. Without this, you’re just asking for chaos.

The quality of a payroll company isn't revealed in their sales pitch; it's revealed in their implementation plan. A detailed, week-by-week schedule is a green flag. A vague "we'll get you set up soon" is a fire alarm.

The single most critical step is getting your data moved over. Your new system is only as good as the information you feed it. If you upload messy, incomplete, or inaccurate employee data, you are guaranteeing paycheck errors, tax miscalculations, and a whole lot of angry emails from your team.

This is where the concept of "parallel payroll" becomes your best friend. For at least one, preferably two, pay cycles, you should run payroll with both your old system and the new provider at the same time.

It’s tedious, I know. It feels like doing double the work, because it is. But the pain of running parallel payroll for one month is nothing compared to the agony of clawing back an overpayment or explaining a tax penalty to your board six months from now.

Finally, don’t forget your team. The best system in the world is useless if nobody knows how to use it. Insist on a formal training session for your employees on how to access their pay stubs, update their information, and use the self-service portal. A little training upfront will save you from becoming the de facto IT support desk every payday.

So you’ve handed over the keys. The sales team sent a nice gift basket, implementation is finally over, and you’re enjoying the sweet, sweet silence of a payroll week that doesn’t end in a migraine.

Don’t get too comfortable.

Signing the contract isn’t the finish line; it’s the starting gun. Managing your payroll outsourcing partner is an ongoing process, not a one-and-done task. If you just set it and forget it, you’ll wake up in a year wondering why your “partner” feels more like a disinterested, expensive pen pal.

The first few months are critical for setting the tone of your long-term relationship. This is where you establish that you’re a savvy, engaged client, not just another customer on their roster.

Start by setting up a recurring quarterly business review (QBR). Yes, even if you’re a small company. This isn’t some stuffy corporate meeting; think of it as a quick, 30-minute check-in to hold them accountable.

Your agenda should be simple:

This forces them to treat you like a priority and keeps your account top of mind. It's also a great way to manage more than just payroll; many companies find that a well-managed payroll provider simplifies the process of outsourcing employee benefits administration, creating a more unified HR function.

Even with the best intentions, sometimes a partnership just doesn’t work out. Thinking about your exit strategy at the beginning is the smartest move you can make. What happens if they get acquired, their service tanks, or they just can’t keep up with your growth?

You need a breakup plan.

Before you even sign, ask them point-blank: "What does the off-boarding process look like? What is the format of the data export I'll receive?" If they don’t have a clear answer, that’s a problem.

This becomes especially important as you scale internationally. It’s a key reason why in-house payroll becomes less viable over time. While 55% of single-country companies manage payroll themselves, that number plummets to just 19% for businesses operating in 6-10 countries. You can read more about how global expansion impacts payroll choices in these payroll statistics.

Having a clear exit strategy isn’t about being pessimistic. It's about being professional. It ensures that if you do need to part ways, you can do it gracefully without disrupting your business or losing critical data.

You've made it this far, so let's get into the questions that are probably buzzing in your head. I've been in your shoes, and I've learned the answers to these questions—sometimes the hard way.

The moment you hire your first employee. No, seriously.

If you find yourself deep in a Google search for "state unemployment insurance tax rates" or feel that familiar knot in your stomach every other Wednesday, you're already behind the curve. This isn’t about how big your company is; it’s about how much your time is worth.

The cost of just one compliance mistake—in penalties, legal fees, or your own lost focus—is almost always higher than a full year of outsourcing fees. Think of it as an investment in not having to mortgage your office ping-pong table to pay a tax fine.

Vague answers about their support model. That’s it.

If you can’t get a clear, direct answer about who your dedicated contact will be, or if they just keep pointing you to a generic 1-800 number and a faceless ticketing system, you should walk away. Fast.

When a tax notice lands on your desk or an employee’s pay is wrong, you need a real person who actually knows your account, not a random support agent reading from a script. Also, any provider who isn't completely upfront about every single fee is definitely hiding something.

Technically, yes. But I wouldn’t do it unless your current provider is a complete disaster. It’s a massive headache.

It’s always best to make the switch at the start of a new quarter or, even better, at the beginning of the calendar year. A mid-year change demands a flawless transfer of all year-to-date payroll data to make sure tax filings like W-2s are perfect. Any decent payroll outsource company will have a process for this, but it puts a much heavier lift on you.

It's doable, just be ready for the extra legwork and maybe a few new gray hairs.